-

AsPayPal and eBay transformed how people buy online, while Amazon redefined global shopping. In the same way, blockchain-powered fintech with stablecoin applications is shaping up to drive the next wave of disruption in global payment systems. Although areas like supply chains and digital IDs are ripe for blockchain adoption, challenges such as market volatility and regulatory pressure have slowed progress. Where others faltered, stablecoins are positioned to succeed. Partnering with a trusted stablecoin development company enables businesses to build applications that serve as reliable exchange mediums, expand digital currency utility, and enhance trading at both macro and micro levels.

Price Volatility is the Reason for Stablecoin Emergence

Due to the market activity that tends to rule the room, Bitcoin and other crypto-assets make headlines. Additionally, high volatility deters entrepreneurs and organizations from using these resources as a means of trade. For sure, how this plays out depends from instrument to instrument. However, making blockchain and cryptocurrencies more palatable to a larger audience percentage will require lower associated uncertainty for these methods. Simply put, if individuals and companies want to use blockchain as a legal fiat substitute, buyers of all sizes and types must be sure that day-to-day continuity will be the value of this alternative. Stablecoin development and its applications offer a possible partial solution in and of themselves. They also open the way for more complex blockchain and crypto implementations.

Source: Bravenewcoin Also, Read | The Emergence of Stable Coins: An Alternative to Cryptocurrencies

Source: Bravenewcoin Also, Read | The Emergence of Stable Coins: An Alternative to CryptocurrenciesWhat's Stablecoin all About?

Today, 180 currencies, from the US dollar to the European Euro to the Japanese Yen and more, are approved by the United Nations. These currencies are also used in the world's economies to buy goods and services. The value of these currencies, amid inflation, fluctuating exchange rates, and other causes, is subject to no adjustment on a day-to-day basis. It helps many economies to rely on the use of these currencies provided by the government to run. You can buy bread from your local bakery, for instance, and pay $4 for it today. You are aware that it's unlikely to drop dramatically to 99 cents tomorrow.

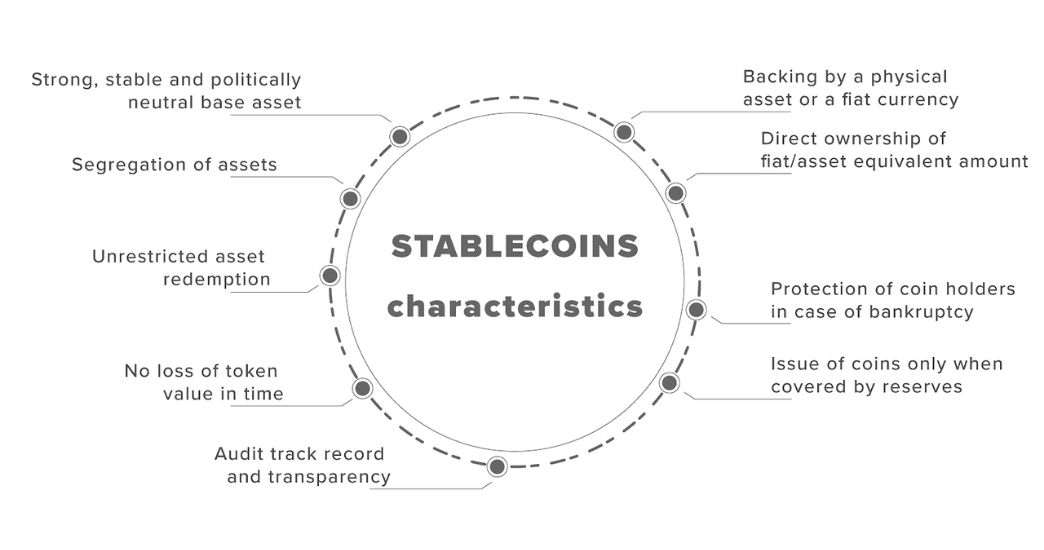

Stablecoin Development Ensures Stability, Liquidity, and Security

Stablecoin is a type of digital currency aimed at imitating conventional currencies that are stable. A stablecoin is a type of cryptocurrency development in which the worth of an underlying asset is collateralized. With unique fiat currencies, such as euros or US dollars, exchanged on markets, several stablecoins get protected at a 1:1 ratio. We may back stablecoin applications with other asset classes, like precious metals such as gold or other cryptocurrencies. Compared to other cryptocurrencies, Stablecoins do not handle the challenges of severe instability. Without losing the trust and stability of a fiat currency, they exploit the advantages of cryptocurrencies. They also include immutability, openness, anonymity, fast transfers, digital wallets, protection, and low fees. A stablecoin has numerous conceivable real-world applications, even though they are only in their early stages. Let us take a look at a few.

Real-World Stablecoin Applications

Enhanced Stability of Crypto Exchange Development

Due to tight rules, so few cryptocurrency exchange platforms out there accept fiat currencies. But using stablecoins helps exchanges get around this issue by merely using a USD-backed stablecoin instead of real dollars to sell crypto-fiat trading pairs. It can support the adoption of cryptocurrency trading as a whole. It because it makes onboarding and possessing cryptocurrencies a simple process for novice investors. Another benefit for them is that they can think of it as in terms of dollars or euros instead of in constantly-fluctuating bitcoin values. It would also reduce the impact of bitcoin on the market, as most exchanges already need traders to keep BTC until they can exchange it for other cryptographic forms.

A Digital Payment Method for Day-to-Day Needs

Stablecoins may find applications for mainstream trade as any other currency, but with the additional advantages of being a constitutionally backed and secure digital currency. As many crypto-enthusiasts have dreamed of, we might eventually be able to take out our mobile and use a blockchain digital wallet payment system to pay for our morning coffee with cryptocurrencies. Stablecoins are also extremely useful for overseas transfers, as no exchange of multiple fiat currencies needs to occur. Without exchanging them into rupees and losing a large percentage of fees, an individual in India might get USD-backed stable coins.

Streamlined and Secure Facilitation of Recurring P2P Payments

Stablecoins also allow the use of smart financial contracts that are enforceable. Smart contracts are self-executing contracts that operate without relying on any third parties to enforce them on a blockchain network. These automated transfers are traceable, straightforward, and immutable, rendering them perfect for p2p lending platforms, payments of salaries and deposits, rent payments, and subscriptions.

A Few Examples

For example, an employer can develop and deploy a smart contract solution. It will automatically transfer stablecoins to its workers timely and securely. As a result, it becomes useful for organizations with workers globally. It is due to eliminating high costs and the days-long process of moving and swapping fiat currency from, for instance, a New York bank account to a Chinese bank account. This approach could take mere minutes and demand just a small fraction of the transaction fees using stablecoins. Another example is setting up a smart contract between a landlord and her tenant for automatic transfer of payments for rent on the first of each month. It is possible without worrying about high market volatility as you would for unreliable cryptocurrency. For automated loan payments, regular subscriptions like gym memberships, or ongoing donations to non-profit organizations, the same concept apply.

Conclusion

The focus has always been on developing cryptocurrencies as a digital currency that is less risky and more liquid. The stablecoin we can call the holy grail to the crypto community. It can enable transactions without friction. It does so not only between crypto transactions but also parties that deal between crypto and fiat. We hope this article helps businesses understand the applications of stablecoins. Need to understand more about Stablecoins and ideate a project development? Our skilled stablecoin developer team can support you throughout the development process, from ideation to concept and development of a token.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.