-

The growth of decentralized finance (DeFi) has led to the proliferation of various financial products and services in the cryptocurrency space. One such service that has gained significant traction in the crypto exchange development space is crypto staking. Staking platforms allow users to earn rewards by participating in the proof-of-stake (PoS) consensus mechanism of a blockchain network. This comprehensive guide explores the concept of crypto staking, its benefits, and the detailed process of developing a crypto staking platform.

What is Crypto Staking?

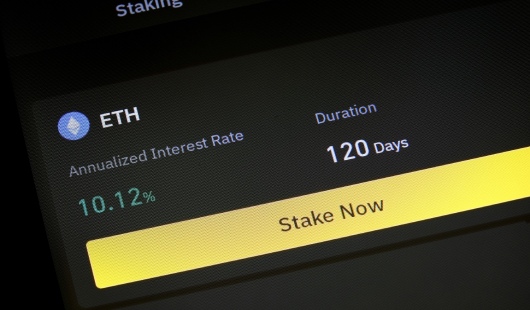

Crypto staking involves holding and locking up a specific amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking their coins, participants receive staking rewards, typically in the form of additional tokens. Staking is integral to the PoS consensus mechanism, where it helps secure the network and validate transactions.

Proof of Stake (PoS) Explained

Proof of Stake (PoS) is a consensus mechanism that selects validators based on the number of coins they hold and are willing to "stake" as collateral. Unlike Proof of Work (PoW), which requires significant computational power to solve cryptographic puzzles, PoS relies on the economic value participants commit to the network. This method is more energy-efficient and scalable compared to PoW.

Also, Explore | Crypto Staking Platform Developed at Oodles

Benefits of Crypto Staking

For Users

Earning Rewards: Stakers earn rewards in the form of additional cryptocurrency, providing a passive income stream.

Network Participation: Staking allows users to participate in the governance and decision-making processes of the blockchain network.

Enhanced Security: By staking their tokens, users contribute to the security and stability of the network.

For Networks

Security: Staking enhances the network's security by making it economically expensive for malicious actors to attack the network.

Decentralization: Encourages more participants to get involved in the network, promoting decentralization.

Efficiency: PoS networks are generally more energy-efficient and scalable than PoW networks.

Also, Read | DeFi Trends for 2024 and Beyond | Insights and Projections

Development Process of a Crypto Staking Platform

Developing a crypto staking platform involves several steps, each requiring careful consideration and expertise. Here's a detailed breakdown of the development process:

Market Research and Planning

Conduct comprehensive market research to understand the existing staking platforms, their features, and user needs. Identify gaps in the market and plan features that will differentiate your platform.

Defining Platform Features

Determine the key features your staking platform will offer. Essential features include:

User-friendly Interface: Ensure the platform is easy to navigate for users of all experience levels.

Multi-Currency Support: Support staking for multiple cryptocurrencies to attract a broader user base.

Security Measures: Implement robust security protocols to protect users' funds and data.

Rewards Calculator: Provide a tool for users to estimate their potential earnings from staking.

Staking Pools: Allow users to pool their resources to participate in staking with smaller amounts of cryptocurrency.

Governance Features: Enable users to participate in network governance and voting processes.

You may also like | DeFi Insurance | A Solution to Decentralized Finance's Risks

Blockchain Integration

Choose the blockchain networks your platform will support. Popular choices include Ethereum 2.0, Cardano, and Polkadot. Ensure seamless integration with these networks to facilitate smooth staking processes.

Smart Contract Development

Develop and audit smart contracts that will manage the staking process. Smart contract development should handle staking, rewards distribution, and penalties for misbehavior.

Platform Development

Develop the front-end and back-end of your staking platform. The front-end should be intuitive and responsive, while the back-end should be robust and capable of handling high volumes of transactions.

Beta Testing

Launch a beta version of your platform to gather feedback from early users. Use this feedback to make necessary improvements and fix any issues before the official launch.

Official Launch

After thorough testing and marketing, officially launch your crypto staking platform. Ensure continuous support and updates to keep the platform secure and user-friendly.

Also, Check | A Definitive Guide to Smart Contract Development Tools

Challenges in Crypto Staking Platform Development

Regulatory Compliance

Navigating the intricate and evolving regulatory landscape can be challenging. Ensure your platform complies with all pertinent regulations to avoid legal complications.

Competition

The market for crypto staking platforms is becoming increasingly competitive. Differentiate your platform by offering unique features and superior user experience.

Technical Complexity

Developing a secure, scalable, and efficient staking platform requires significant technical expertise. Bring together a team of skilled blockchain developers to tackle technical challenges.

Discover | Cross-Chain DeFi Technology | Shaping the Future of Finance

The Future of Crypto Staking

The future of crypto staking looks promising as the demand for PoS networks and staking services continues to grow. Here are some trends to watch:

Increased Adoption

As more blockchain networks adopt PoS consensus mechanisms, the adoption of staking platforms will likely increase.

Integration with DeFi

Staking platforms will likely integrate more with decentralized finance (DeFi) protocols, offering additional services like lending, borrowing, and yield farming.

Enhanced Security Measures

As security threats evolve, staking platforms will continue to enhance their security protocols to protect user funds and data.

User-Friendly Innovations

Future staking platforms will focus on improving user experience by offering more intuitive interfaces and better educational resources for newcomers.

Explore More | NFT Lending and Borrowing | When NFT Meets DeFi

Conclusion

Crypto staking platforms play a vital role in the blockchain ecosystem, enabling users to earn rewards while enhancing network security and stability. Building a successful staking platform requires meticulous planning, strong security protocols, ongoing community engagement, and the services of a crypto staking platform development company. Despite the inherent challenges, the future of crypto staking is promising, offering substantial opportunities for growth and innovation. Embracing this technology paves the way for a more inclusive, efficient, and secure financial system.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.