-

Blockchain has transitioned into a medium that various industries are adopting to achieve trust, increase transparency, strengthen security, and enhance efficiency in business operations.

The transition of this promising technology is noteworthy that even key industry players in healthcare, real estate, automotive, insurance, and financial services are moving toward blockchain and smart contract development services to avail solutions that create value in the business network.

What is Blockchain?

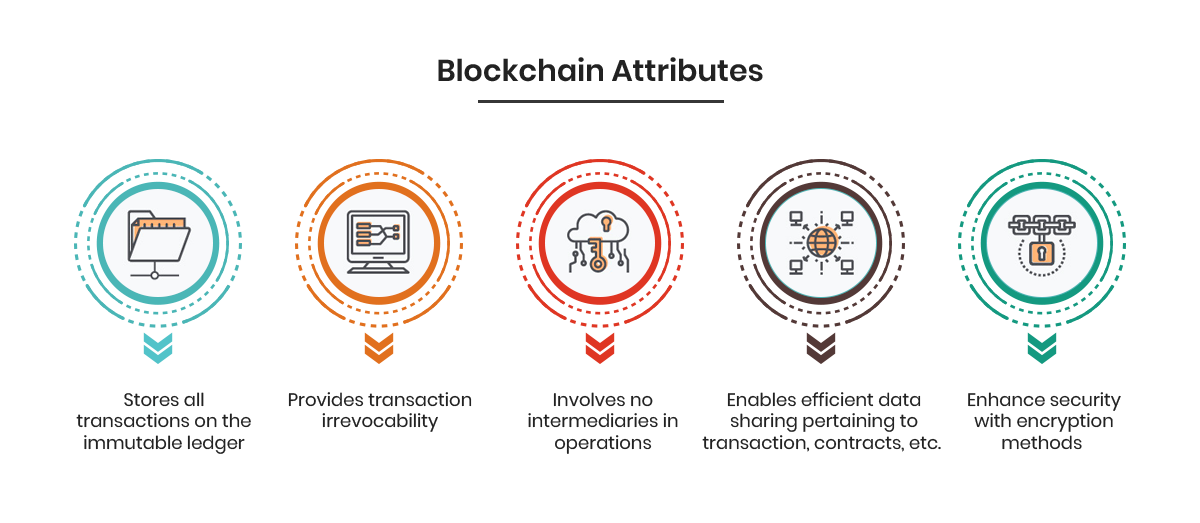

Blockchain is a form of distributed ledger technology that provides a secure and efficient platform for storing and maintaining a growing list of transactional data records. Once stored on the blockchain platform and verified through smart contracts, the transactions become immutable and irrevocable. Immutability and irrevocability play a significant role in fintech solutions. With such features, fintech service providers can eliminate risks of data temper, hacks, and threats, create efficiency by removing intermediaries from business operations, and operate a trusted network of peers.

What is Smart Contract?

A smart contract is a computer protocol that automatically executes, enforces, and verifies business rules encoded in a digital contract. When it is being executed, nobody can change, alter, and influence the behavior of the business rules.

Essentially, it is deployed with the blockchain solution to ensure authentic information flow in the network. However, some blockchains provide provisions for changing the smart contract rules as per the mutual consent of all transacting parties. Use of several blockchain based consensus (verification) methods and mechanisms also play a crucial role in the sustainability of the smart contract solution. Their implementation depends on the type of distributed ledger technology and unique business requirements. Some standard DLT based verification methods (consensus algorithms) are proof-of-work, proof-of-stake, byzantine fault-tolerant (BFT), and special notary nodes.

Blockchain, Smart Contracts, and Financial Services

Financial services encompass a wide range of businesses that manage money, including credit unions, banks, insurance providers, consumer-finance companies, stock brokerages, investment funds, and so on.

These services can achieve efficiencies with decentralized or permissioned applications enabled by blockchain smart contracts.

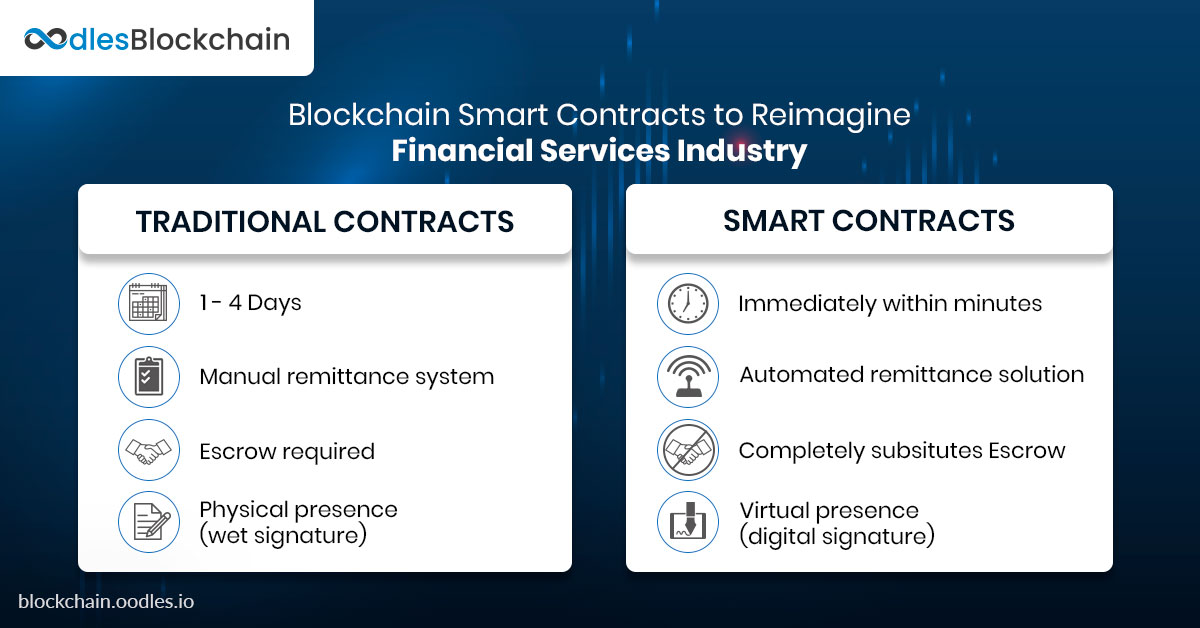

For instance, a blockchain-based smart contract can replace traditional escrow service with a digital automated solution.

Trust

Organizations get features like irrevocability, peer-to-peer transactions, and cryptographic security implementations to ensure trust in transactions, and prevent data modifications.

Verifiability

It has provision to invoke every transaction ever stored on the database for verification and audit scenarios while maintaining immutability.

No intermediaries

Smart contracts eliminate intermediaries from the financial ecosystem to reduce transaction costs, accelerate data transfers, and strengthen security.

Advantages of Blockchain Smart Contracts

Smart contract brings transparency, traceability, process automation, quick and easy contract execution, cost-effective processes. Smart contract help in removing unwanted third-parties and hence the intermediary fee. Third-parties elimination depends on the processes

Here are a few advantages of blockchain smart contracts that are most suitable for banks and other financial organizations.

- Features like irrevocability, peer-to-peer transactions, and cryptographic security implementations to ensure trust in transactions, and prevent data modifications

- Provision to invoke every transaction ever stored on the database for verification and audit scenarios while ensuring immutability

- Elimination of intermediaries from the financial ecosystem to reduce transaction costs, accelerate data transfers, and strengthen security.

Smart Contract Use Case in a Fintech Application

Blockchain developers can code business rules in a smart contract to describe and control every prospective outcome of a transaction. For instance, it can manage what will happen:

- If the shipment reaches to the distributor on time?

- If there is a delay from the seller’s end?

- If the shipment is lost?

- If there is a delay due to customs?

- If the exchange rate fluctuates in real-time?

A smart contract can execute the exchange of payment if the buyer and seller conditions are met, such as timely shipment delivery. If there is no delivery, a smart contract releases the funds to the involved party’s account.

Smart contracts are most trustworthy and can efficiently move legal contracts on blockchain. They can be partially or fully executed or enforced without human interaction and any bias.

A few additional measures that double the credibility and security of smart contract-based transactions:

- Verification procedures KYC and AML

- Immediate irrevocability

- Automated execution of smart contracts

Now, let’s explore blockchains that provide the platform for creating efficient smart contract-based fintech services:

Distributed Ledger Technology Platforms

Several open-source DLT based platforms like Ethereum Platform, Hyperledger Fabric, and R3 Corda have earned a reputation for providing innovative smart contract solutions.

R3 Corda

Corda is a distributed ledger technology for developing private permissioned solutions for financial institutions like banks and insurance companies. It aims to automate legal prose with a smart contract solution. In other words, it can completely substitute legal paperwork.

Corda’s private ledger technology enables selective permissioned exposure of information about every transaction (and every smart contact) in the network. It strengthens privacy and increases efficiency as the transaction details are not shared with all peers in the Corda network. Instead, they are available only to parties directly involved in a particular transaction.

Corda’s smart contracts also have a provision for creating notary nodes that are established as third party transaction verifiers for business-critical transactions. These authenticated digital notaries can work as public financial regulators, auditors, banks, and other entities.

Ethereum Blockchain

It was the Ethereum Platform that introduced smart contracts as the autonomous agents to the physical world. Ethereum, a public blockchain, uses Ethereum Virtual Machine (EVM) to verify and execute smart contracts. EVM refers to a network of nodes and miners that ensure no one cheats.

The key component that sets Ethereum and R3 Corda blockchain application development apart, is their consensus mechanisms. While Corda uses notaries for transaction verification, Ethereum smart contracts use proof-of-work (PoW) methods. There are also talks about Ethereum smart contracts introducing alternatives like proof-of-stake (PoS) and other mechanisms as well.

What Do We do?

Financial institutions can benefit from blockchain technologies like Ethereum, Corda, or Hyperledger. We, at Oodles, provide blockchain development services to build custom distributed ledger-based solutions for your unique financial services requirements. Our blockchain team develops custom solutions to provide greater control over processes and minimize transaction costs.