-

Blockchain and the peer-to-peer (P2P) lending model are a natural fit. By leveraging blockchain, P2P lending platforms can create new business models and enable secure transactions without relying on traditional trust-based relationships between lenders and borrowers. In this post, we'll examine the key challenges that conventional P2P lending platforms face and explore how blockchain technology can provide effective solutions. For organizations planning to innovate in this space, partnering with a P2P crypto exchange development company can accelerate the development of secure, transparent, and scalable P2P lending applications.

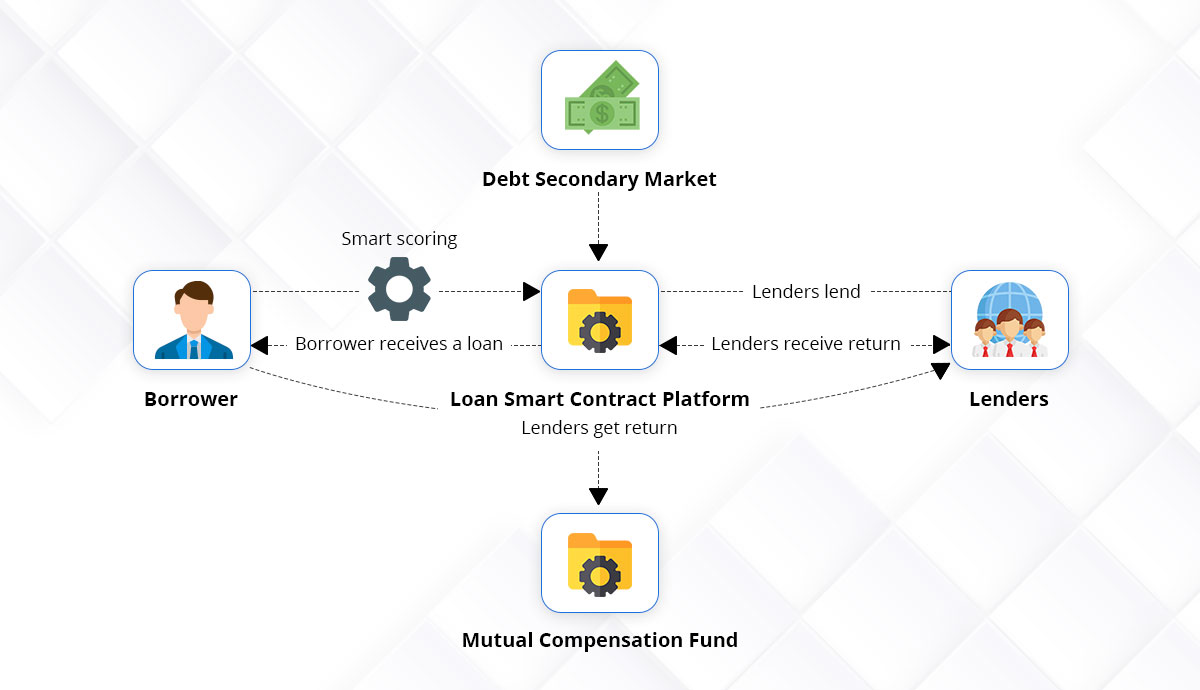

Blockchain-Based P2P Lending

Peer-to-peer lending links investors/lenders with borrowers through an online platform that acts as an authentic third party. The stakeholders that get involved in the operation are:

- Private individuals or organizations which provide funding

- An online p2p transaction management tool

- A company or private person seeking funding

However, the need for intermediaries and regulation in the conventional P2P lending model means transactions on traditional peer-to-peer sites are subject to additional cost and time restrictions, as well as security concerns. Blockchain is at the core of the FinTech revolution and can fundamentally transform a wide variety of sectors, from financial services and lending to P2P. In peer-to-peer lending, the main benefit of using blockchain technology is that it can eliminate intermediaries from the lending process. It has a wide range of advantages which we will discuss in the next segment. First, we will include a brief introduction to blockchain technology and how blockchain's core features are also crucial in lending to P2P.

Blockchain and P2P Lending | Key Features

Blockchain technology's two key characteristics are its trust-evoking and decentralized design – both are also important to the growth of P2P lending. Trust and decentralization are inextricably related to blockchain technology. You require mechanisms to establish a trust to create a decentralized network, and decentralization enables users to get active in it and to lay the groundwork for a consensus process that will remove the need for a trusted third party. Also, Read | Analyzing the Components of a Blockchain-powered P2P Lending Platform

P2P Lending with Blockchain Technology

Transparent Network

A blockchain-based P2P lending network enables enhanced trust by making information accessible to the participating borrowers and lenders. All participants providing full disclosure to all activities will show all past and current transactions, and when a new one happens, it gets transmitted across the entire network. Furthermore, because no single entity manages the mechanism, lenders and borrowers may participate directly throughout the process and thus reducing friction.

Authentic Data Exchange

Information integrity is protected by peer review of transactions and through public-key cryptography allowing direct contact. As a result, each user can check the accuracy of the information being broadcast based on predefined laws.

Immutable Data

Data immutability is the final key factor in building trust. A database built using blockchain technology gets constructed in such a way that nobody can alter transactions once connected to the blockchain. The process of adding information to a block takes place through an agreement mechanism that involves proof of work – a computational problem that other network members need to answer. Also, read | Building Next-Gen Fintech Solutions with Stellar Blockchain

Privacy Mechanisms

Depending on the form of blockchain, pseudonyms will mask the identity of the users. It, with the use of public-key cryptography to protect interactions, promotes a degree of privacy for P2P loan platform users. Find out more about the various forms of blockchain in the "Blockchain Forms" section below.

Authenticity

The system's authenticity is developed by exchanging and storing knowledge about transactions within the network, and by encouraging automated steps that minimize the need for manual intervention and thus the risk of individual errors.

Versatility

Blockchain technology enables peers to participate in the creation of the underlying code which supports the database, creating an open and scalable framework where participants can create and distribute their code and functionality. It allows smart contract creation – a contractual arrangement between two parties, which are a lender and a borrower in P2P lending, based on a piece of code that gets configured to satisfy the contract terms automatically.

Smart Contracts in P2P Lending

Another significant aspect of using blockchain in peer-to-peer lending, though, is the ability to build smart contract solutions. They ensure that transactions negotiated by the parties (lenders/borrowers) get autonomously executed according to rules specified in the smart contract. In other words, a smart contract is a file based on the parameters defined by the parties, with a self-execution code. We call blockchains that support smart contract functionality blockchain 2.0. A smart contract in P2P lending will include the initial amount of the loan and the terms of repayment, including penalties if payments are late or skipped. For example, a company makes a loan of $100,000 with a repayment period of 24 months at $5,000. A smart contract solution will automatically execute the payment requests, obtain the payments, and change the due sum without any intermediary having to be involved. Additionally, it incorporates automated compensation features in the smart contract, such as deducting percentages for early loan repayment, changing credit scores, or converting to a higher yield currency.

Blockchain Platforms

Blockchain is often spoken of as it is all the same, but in reality, there are various forms of blockchain. As most people talk about this technology, they usually discuss a permissionless public blockchain like Ethereum, but there are also other forms of blockchain. Although all types of blockchain share similar features such as a distributed network, cryptography, and timestamped transactions, the capacity of users to read and send information to the blockchain, and more. This skill depends on their exposure to transactions and has major consequences for how blockchain can be used by peer-to-peer networks in lending P2P.

Conclusion

The peer-to-peer lending industry is now challenging conventional debt providers by offering investors an exciting opportunity to achieve attractive and secure returns and diversify their investment portfolio, as well as providing a frictionless way to meet borrowers' funding needs. But banks and mainstream financial institutions also dominate the lending industry. P2P networks must further evolve the peer-to-peer business model to disrupt the sector more profoundly. Blockchain technology potentially plays a crucial role here.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.