Also, read | Entering the Crypto Market with Peer-to-Peer (P2P) Crypto Exchange Development

Advantages over a Centralized Exchange

P2P exchanges support excellent tolerance to censorship of transactions. They are inexpensive to use and private and secure when developed appropriately. The benefits of decentralized exchanges for cryptocurrencies come from not having a single entity in control. A single point of authority provides several advantages-the quicker trades, in particular. It also acts as the single point of failure, meaning any bit of damage to it will affect the entire system.

Cost-effective operations

It is the people who run regular crypto exchanges, and they get paid for their jobs. On the other hand, software systems operate P2P transfers, so there are little or no corporate overheads, and, by default, very minimal user fees, if any.

Resistance to transactional censorships

Standard cryptocurrency exchanges are operated by people, making them vulnerable. Also, policymakers may manipulate them by enforcing regulatory restrictions.

P2P exchanges are virtually invulnerable to intervention by the government, as they have no central point of authority for manipulation. Even if a few sections stop running, the remainder of the system remains unchanged. This advantage is what caused a marked increase in the user base P2P exchanges.

Secure

P2P exchanges do not keep cryptocurrencies of their customers. Instead, they link traders with each other. It enables them to conduct transactions directly. The method is made much simpler by not having to entrust your coins to a third party. If no one owns your funds except you, so no one can steal or lose them-either deliberately or by mistake.

Smart-Contract powered Escrow Service

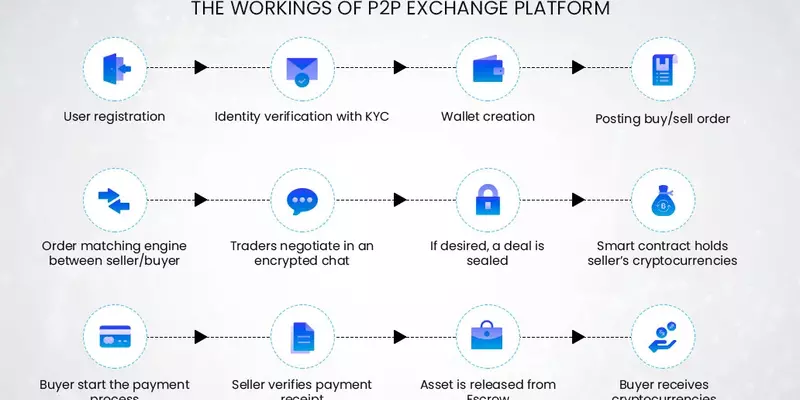

A smart contract-powered escrow service serves as a trusted intermediary service that maintains the money for a transaction until the settlement of cryptocurrencies is over. They protect customers from fraudulent sellers by requiring the cryptocurrencies to deposit in advance before any exchange of money.

Regulatory Compliance

Exchanges must get permits, depending on where they operate. In the United States, the Securities and Exchange Commission (SEC) regulates them. Within the European Union (EU), this is achieved following the EU Electronic Money Directive under the EU Payment Services Directive.

Knowing what the latest rules are, how to stay compliant, and what to avoid is crucial now and in the future for cryptocurrency trading.

Also, read | Analyzing Peer-to-Peer (P2P) Cryptocurrency Exchange Model

Benefits of the Development of P2P Crypto Exchange with Oodles

Desired Trading

Buyers get the jurisdiction to choose their preferred sellers for a more open and trusted trading experience, backed by escrow service.

Matching Engine

A high-speed matching engine capable of matching real-time buyers and sellers manages the exchange efficiently. It includes built-in buy order forms for buy and sell orders to ensure fast trading.

Multilayered Protection

Top-notch security mechanisms such as SSL implementation and two-factor authentication add to the P2P exchange platform developed by Oodles an integral layer of protection.

Different Methods of Payment

Traders can send, receive, or request payment in the P2P network using various payment methods such as PayPal, Bank Transfer, UPI, etc.

Exchange of Multiple Cryptocurrencies

The exchange platforms provide provision for the transaction of several cryptocurrencies like BTC, ETH, XRP, BCH, LTC, etc.

Multiple Language Support

P2P exchange platforms developed by Oodles support several languages. It makes them readily available or understandable in the world by anyone. We strive to provide the best user experience; for every customer, from every corner of the world, and every nook.

KYC and AML Checks

It enables an admin to search and validate KYC / AML information of users to stop scam attacks.

Atomic exchange

A peer-to-peer swap ensures transactions of trusted users, eliminating the need for an intermediary. Atomic swaps advance around either completing or ending the trades, thus, reducing the likelihood of conflicts in a situation of breach of the agreement.

Administrative Panel

A secure admin panel provides admins with smooth controls to effectively manage critical elements such as the escrow system and dispute management.

Dispute settlement

A robust dispute management system empowers the administrator with seamless redress from disputes. Full insights into the transaction history of users and bank statements help administrators to manage disputes and strengthen their decision.

For more information about the development of a peer-to-peer exchange platform for your traders without any third-party or central authority, connect with our experts.