-

Stellar came into existence in mid-2014. It emerged after a rift between executives of the Ripple blockchain, a platform cross-border payment solutions. Then, Stellar started gaining traction in developing countries where the remittance sector plays a crucial role. Since then, it has continued to expand its reach by establishing partnerships with key players around the globe. But, can Stellar blockchain development provide those features and capabilities that make it a suitable platform for cross-border payments? Let’s explore!

Understanding Stellar

Often, people use Stellar to refer to multiple things, which makes its characteristics ambiguous. Precisely, it has three different aspects, namely Stellar, Lumens, and XLM. Stellar is a blockchain-powered distributed ledger network. Lumens is the cryptocurrency specifically for the Stellar blockchain network, while XLM is its coin’s symbol.

While Ripple is for Institutions, Stellar is for Everyone

After selling Mt. Gox, McCaleb, moved onto a new project called Ripple. Ripple was a DLT platform designed to facilitate cross-border payments. It aimed to revolutionize cross-border remittance payments while seeking to address two problems, high costs and long processing times. Ripple focused on simplifying the process by empowering financial institutions that usually have to interact with several different institutions for cross-border payments. With Ripple blockchain solutions, banks could make cross-border transactions without involving any intermediary or third-party.

McCaleb left Ripple in 2014 to create more fast and cost-effective solutions for individuals rather than financial institutions. He wanted to increase the service’s scope to geographies with almost limited to nonexistent access to banks. Subsequently, McCaleb and fellow co-founder Joyce Kim launched the open-source blockchain platform, Stellar, for payment solutions.

Stellar Blockchain’s Features for Cross-Border Payments

Decentralized, Open-Source Database

Stellar follows the principles of a decentralized and open-source network. It means that Stellar operates without depending on a specific central authority, such as a few employees of a bank.

Unique Consensus Method

Stellar uses a unique method known as a Federated Byzantine Agreement (FBA) for consensus. It means that rather than waiting to verify a transaction until network agreement, individual nodes choose other trustworthy nodes called Quorum. The group of reliable nodes also selects other nodes they find authentic to make quorum slices. Once quorum slices reach consensus, the ledger accepts and stores a transaction.

Speedy Confirmation Time and Transactions

Stellar’s confirmation set-up, combined with the fact that it doesn’t require mining, expedites transaction processing. Consequently, on average, stellar confirmation takes three to five seconds, and its network can process thousands of transactions at once. It makes it a highly scalable blockchain platform.

Also Read: Stellar Blockchain: Understanding its Benefits for Payment Solutions

An Imaginary Process of Executing Cross-Border Payments on Stellar

Stellar has paved its way into the mainstream by establishing partnerships with a few high profile companies. Here’s a hypothetical scenario that explains how a Stellar based payment solution can strengthen cross-border transactions in three simple steps

Overview

- Alice, in the USA, needs to transfer funds to Bob in Brazil

- Both Alice and Bob have digital wallets to store, transfer, and trade tokens used in the Stellar network.

- Alice wants to transfer funds through her local currency, USD, however, Bob needs to receive his local currency, BRL.

- The following diagram demonstrates how a cross-border payment, which has 2 users, 2 wallets, and 2 anchors, executes on Stellar.

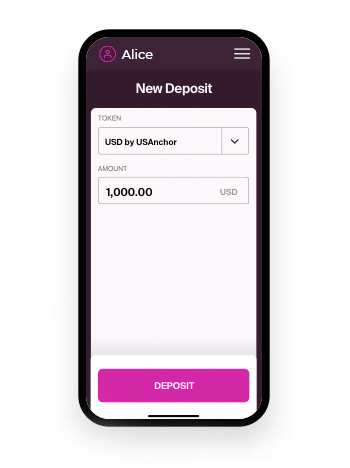

1) Alice funds her account

- She enters the amount in USD that she would deposit

- Submits her KYC details

- Receives instructions for the deposit

- Sends money via ACH

- Receives tokens in USD in her integrated wallet

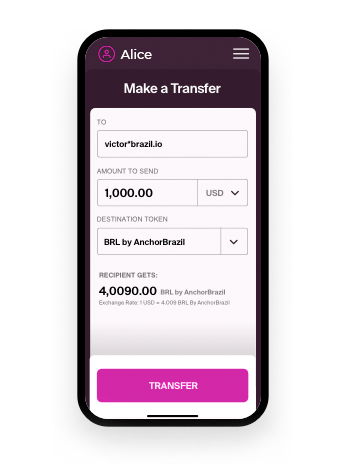

2) Alice sends money to Bob

- Alice types the wallet address of Bob

- Selects the option to transfer USD

- And for Bob to get BRL

- Confirms the transaction

- Bob receives funds in his wallet within a few seconds

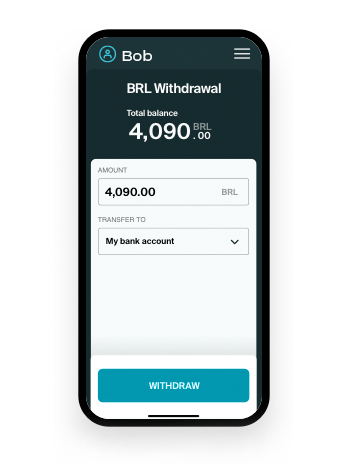

3) Bob withdraws funds from his wallet

-

-

- Bob types the BLR amount he wants to withdraw

- Submits his KYC details like Alice

- Provides his bank account details

- Confirms the withdrawal transaction

- Receives BRL in the account via ACH

-

Conclusion

Stellar enables fast, cost-efficient, and simplified payment integration solutions , especially for individuals around the world. It provides them the capability to make payments in any currency pair, which creates new possibilities for the financial markets.

If you are looking to kickstart your financial services venture, take a look at our blockchain app development services for cross-border payments and other use cases.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.