-

Blockchain technology is a distributed ledger technology that carries the potential to digitize and accelerate banking processes requisite security mechanisms. It overcomes challenges arising from traditional manual, inefficient, and time-consuming banking practices. It revamps those banking activities by providing the following benefits explained in detail in this blog post.

Efficiency, Transparency, and Security

Blockchain solutions ensure trust, transparency, efficiency, and security in the network with cryptographic mechanisms, P2P transaction methods, and immutable, distributed ledger. Although a distributed ledger enables all participants in a network to view transactions, it does not permit them to modify it without consensus. Thus, eliminating manual efforts required for verification and reconciliation with smart contract technology that can generate an automated audit trail of financial transactions. Also, as a distributed ledger is immutable and irreversible, it eliminates the risks associated with frauds and modifications. It also eliminates the need for intermediaries with immutable transaction logs in real-time.

Implementing Blockchain in Banking Provides?

Single Source of Truth

Today, conventional banking largely depends on manual, paper-based legacy systems to fulfill stakeholders' requirements involved in every transaction. Blockchain provides a shared but encrypted digital infrastructure to expedite transactions, including contractual agreements. For instance, a mortgage loan process requires a string of checks and balances between borrowers, loan officers, underwriters and home buyers. Blockchain can connect all the actors by updating the ledger automatically in a transparent manner.

Reduced Dependency on Intermediaries

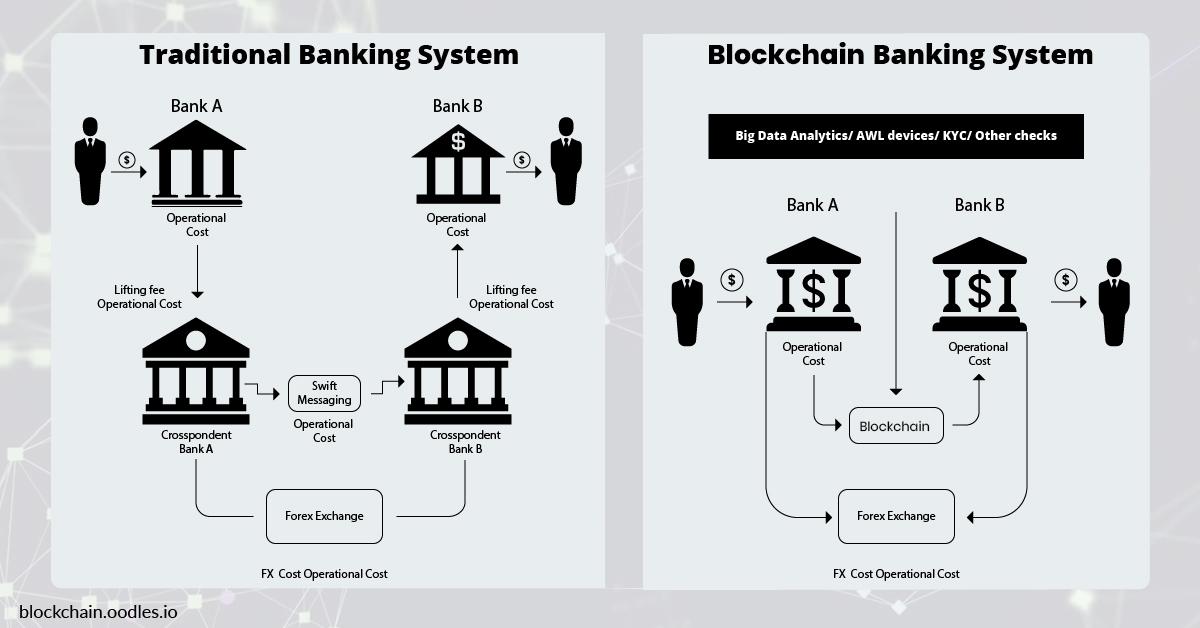

Traditional banking transactions occur through a centralized system of authorities and intermediaries. Consequently, payment settlements extend from days to weeks. Blockchain powers smart contracts to eliminate third-parties and enable instant, compliant and transparent payments efficiently, for instance, cross-border remittances and fund transfer.

A high-level overview of the blockchain banking solution that eliminates intermediaries and increases efficiency

A high-level overview of the blockchain banking solution that eliminates intermediaries and increases efficiencyReal-time Cross-Border Transactions

Sending money across international borders through traditional means always remains subject to anti-fraud checks, foreign exchange, and fund clearance. Blockchain solutions make cross-border payments efficient with peer-to-peer payment networks and decentralized authentication, all in a compliant manner.

Reduced Fraud Risks and Increased Transparency

Unlike centralized banking ledgers, blockchain decentralizes the stored data with immutability and security mechanisms like cryptography. It does not store data of financial transactions and ownership in one single place. Instead, all stakeholders in a network keep a copy of such data. Subsequently, any fraudulent activity or data breach becomes avoidable and instantly traceable.

Streamlined KYC and Customer Verifications

KYC and other customer verification checks cost the financial services industry on average $50 million, and some financial institutions even spend up to $500 million a year, according to the Thomson Reuters survey. Augmenting these processes with blockchain can enable banks to access customers’ verified information instantly. Further, they can efficiently, securely y share it with third-parties like savings and loan associations, mortgage companies, insurance companies, and brokerage firms with compliance.

Costly Cross-Border Remittances

Currently, according to the World Bank, the global average processing charge of remittances is 7.7% of the transaction value. It has a significant impact on those who want to send money across borders.

Global Cross-Border Remittance System: Current Challenges

- Increased de-risking activities

- Failure to adhere to regulatory standards

- Lack of interoperability

- Expensive private remittance channels

- An inefficient traditional money exchange system

Companies operating in the remittance industry have begun to use blockchain technology as the backbone of new systems. They are exploring blockchain to overcome challenges such as high costs, high turnaround time, and vulnerability of legacy systems.

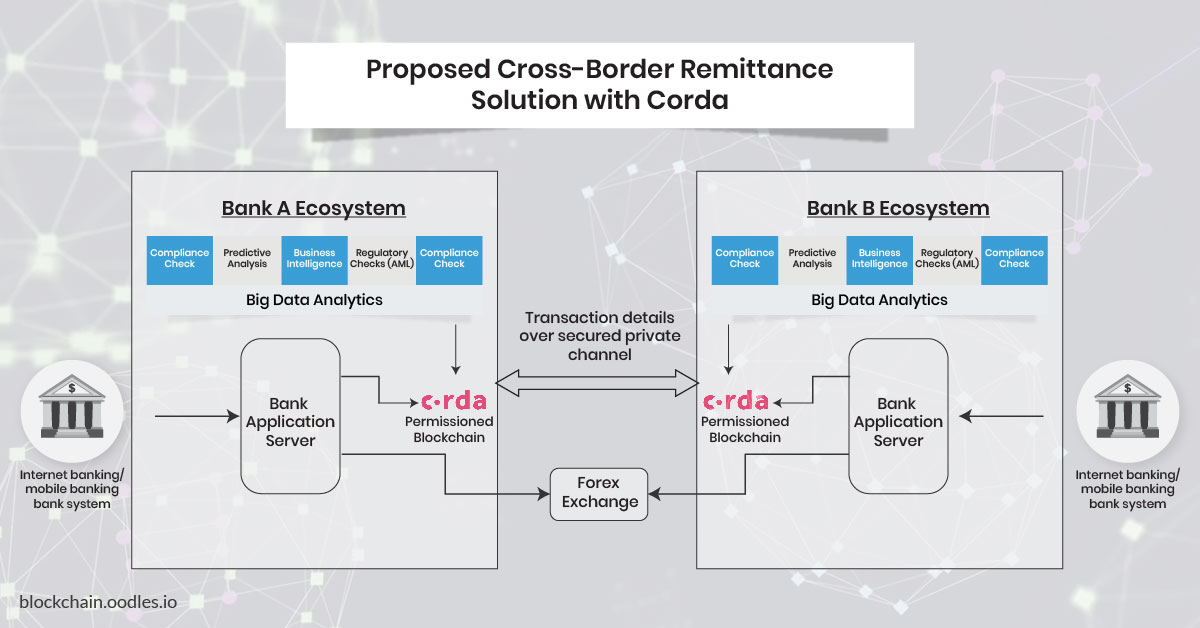

Solving the Challenges with Corda

Our blockchain specialists at Oodles use Corda blockchain development services to streamline legacy cross- border payment processes. Corda can optimize the “pipes” through which the majority of cross border money flows. Corda remittance solutions provide the following benefits:

- Remove intermediaries, reduce operational costs, and enable minimal involvement of correspondent banks

- Provide cheaper and quicker remittance transaction solutions

- Improve visibility to information for banks and their customers

- Conduct bank to bank direct transfers

- Enable secure transactions between banks and access based visibility to data

- Reduce the cost of cooperation with correspondent banks and SWIFT messages

An overview of the Corda blockchain-based cross-border remittance solution

An overview of the Corda blockchain-based cross-border remittance solutionCorda at a Glance

Corda is a blockchain enterprise platform specially designed to enhance financial services and develop efficient public and private (permissioned) banking solutions. It addresses various banking challenges and lays the foundation for new revenue streams. On the one hand, it works as a permissioned network to enable a group of organizations to record, manage, share, and synchronize contracts or other information privately. On the other hand, it operates as an open-source platform that financial institutions can use to build public applications on top of it.

Conclusion

Banks can avail multiple benefits with blockchain application development, such as faster syndicate formation, digitized documentation, quicker KYC operations, data integrity and immutability, and much more. Blockchain-based solutions can automate several time-consumption and manual processes, expedite settlement cycles, and eradicate duplication of efforts and intermediaries.

Distributed ledger technologies like blockchain can lay the foundation for a better global banking experience.

How Oodles Can Help?

Oodles has the experience and knowledge required to develop applications and blockchain banking solutions that can simplify complex processes of the financial services industry.

If you’re considering outsourcing your next fintech project either for software development or complete platform development, drop us a query.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.