-

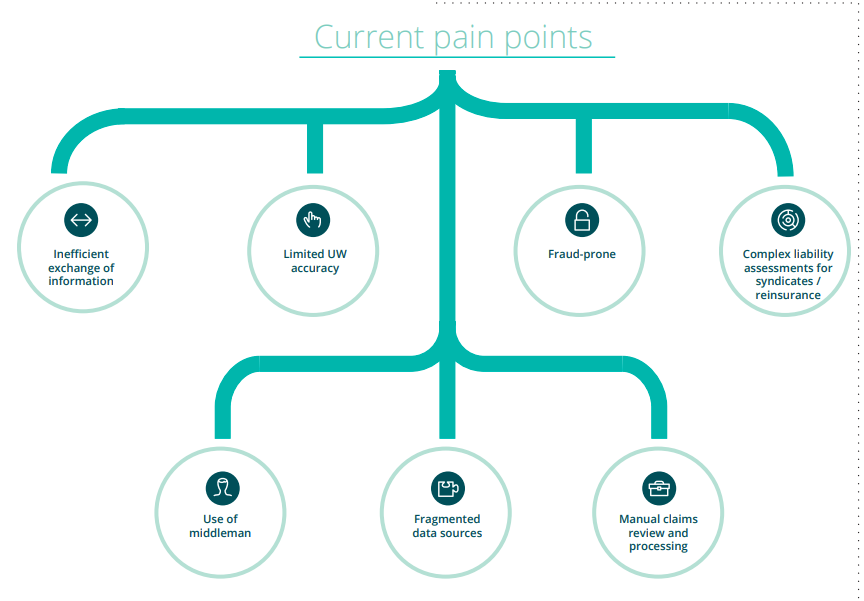

The insurance industry is one of the key influencers within the global economy. Various entities, including businesses, citizens, healthcare organizations, and governments, require a variety of insurance services. However, the current insurance system is full of challenges due to the substantial size of the market and the involvement of multiple intermediaries. It lacks coordination and interoperability of data between parties and stakeholders. Here, smart contract development can prove to be more convenient and efficient than drafting inconvenient paper agreements.

Source: Deloitte

Blockchain-powered Smart Contracts

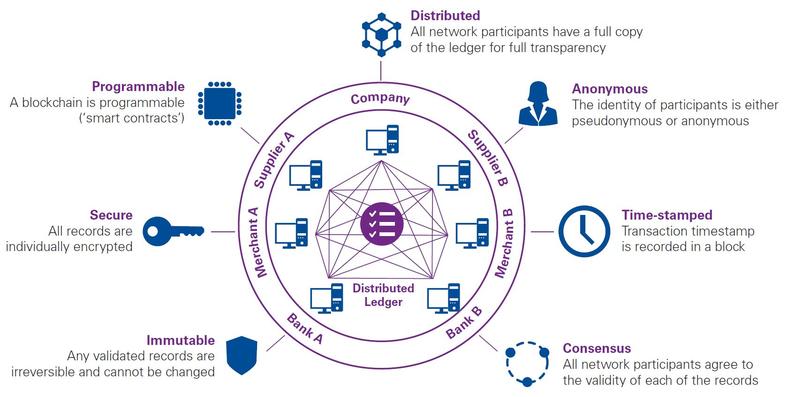

A smart contract is a digital self-executing business contract that runs on a blockchain. Essentially, it automates the execution of transactions upon the fulfillment of pre-defined business terms by two or more parties. Smart contract developers write them into lines of code on a blockchain platform like Ethereum for their self-execution with efficiency and security. These codes exist across a shared, decentralized blockchain network, either in a permissioned or private one. While smart contract codes manage the execution of transactions upon the fulfillment of If/Then conditions, blockchain makes them trackable and irreversible.

Smart contracts can even validate and execute transactions and agreements among anonymous parties without a central authority, legal system, or external enforcement mechanism.

Source: KPMG Global

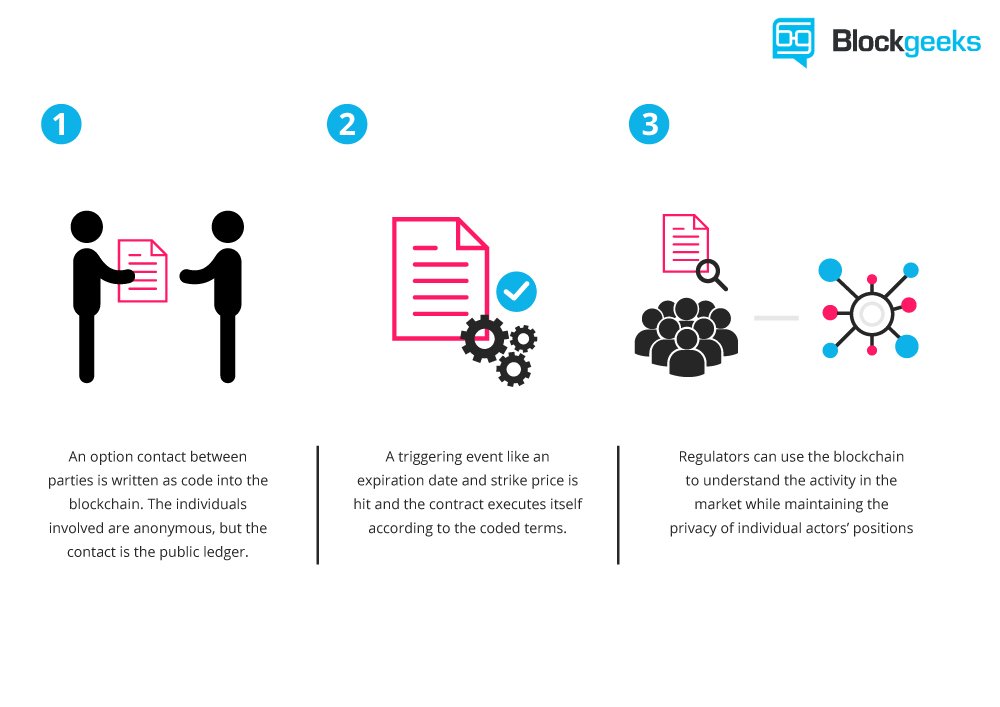

Workings of a Smart Contract

For instance, Alice wishes to sell her car to Bob in exchange for payment in cash. They code a smart business contract on Ethereum blockchain, stating that IF Bob pays $10,000 to Alice, THEN she will automatically receive the ownership of the car."

As the smart contract agreement resides in a blockchain environment, shared across the network nodes, nobody can change it without consensus. Bob need not worry about Alice suddenly demanding more money. Besides, she need not pay any additional charges to third-party companies like banks, a lawyer, or a car broker to prove that Bob has received the payment.

Source: Blockgeeks

Now, let us take a look at a few advantages that a smart contract for insurance stakeholders can provide.

Blockchain Smart Contracts in Insurance | Advantages

There are multiple advantages of using smart contract solutions over traditional contract arrangements. Given the rapid development of blockchain technology and smart contracts, the following list of their capabilities for the insurance industries will likely increase in the future.

Accuracy

As its primary requirement, a smart contract requires recording of all terms and conditions in explicit detail. It is a key requirement because an omission may lead to errors in transactions. Hence, automated contracts enable insurance companies to avoid the pitfalls of manual filling of policy contracts.

Transparency

As the terms and conditions of an insurance contract are coded on a blockchain platform, they become completely visible and accessible to all relevant parties. The parties in a contract cannot dispute them once established, thus facilitating complete transparency of transactions and contract terms across all concerned parties.

Efficient communication

Accurate mention of the contract and policy terms results in everything being explicit. It leaves no room for miscommunication or misinterpretation. Therefore, smart contracts drastically reduce efficiency lost to gaps in communication, despite parties' physical locations.

Time-saving

These contracts run on the blockchain and essentially exist on the internet. Consequently, they can carry out transactions with significant speed. The speed leads to saving hours spent in many traditional insurance processes. It eliminates the need to process documents manually.

Security

Automated contracts leverage the use of the highest level of data encryption and blockchain’s feature-rich security characteristics. The advanced level of protection makes them secure and efficient for business use cases requiring efficiency with strengthened security.

Dispute free

In each transaction, these contracts record essential details. So, whenever insurance details are used in a contract, they are stored permanently for future records. Those attributes are easily retrievable in the event of data loss or dispute of a claim.

Outcome-based

Another appealing aspect of such arrangements may be the ability to greatly minimize or even remove the need for lawsuits and court hearings.

By using a contract of self-execution, parties undertake to bind by the rules and determinations of the underlying code.

Applications of Smart Contracts in insurance

Insurance companies are well aware that the application of smart contracts combined with blockchain may lead to the automation of the insurance process: from the verification of the claim to the payment of indemnity in favor of the insured.

Automated claims processing and handling

Defining insurance policies on a blockchain as smart contracts can radically transform the efficiency of Property & Casualty (P&C) insurance services. As per a report by BCG, it can save insurers more than $200B a year in operational costs. Deploying insurance policies and claims management data on a blockchain solution that insurers, reinsurers, brokers, and other parties can readily access reduces duplicate, manual work. Insurance policies deployed as smart contracts solutions on the blockchain can automatically carry out programmed claims processing actions.

Further, it can automate information transfers between insurers and other parties, and making payments to policyholders. Additionally, more information like claims forms and supporting evidence provided by policyholders can reside on the blockchain so that all parties access the same information, making disputes improbable.

Also, Read | Game-Changing Potential of Blockchain in Insurance (Claims Processing Use Case)

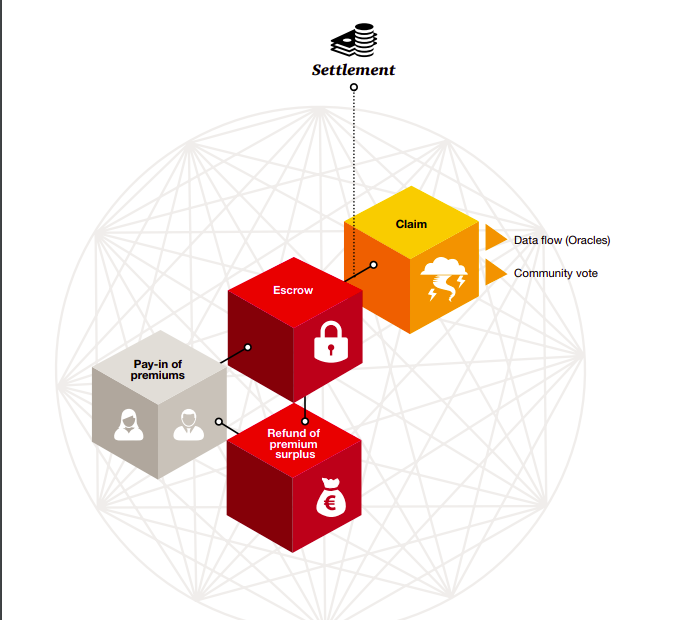

Peer-to-peer insurance model

Peer-to-Peer (P2P) insurance generally comprise a group with a certain degree of affinity (family, friends, business associates, etc.). The group members collaborate to insure each other against loss. Blockchain smart contracts can improve the efficiency and transparency of the p2p model. A smart contract can hold written premiums in a secure escrow account.

Further, it can provide claim amounts from the escrow when the correct digital signature is applied. Also, the smart contract’s code might require multiple members of the pool to provide their signatures to validate the claim and release the payment. In the future, we may see specific P2P insurance platforms using smart contracts to set claims and match demand between consumers.

Source: PWC

Also, Read | Blockchain in Insurance: Enabling New Opportunities

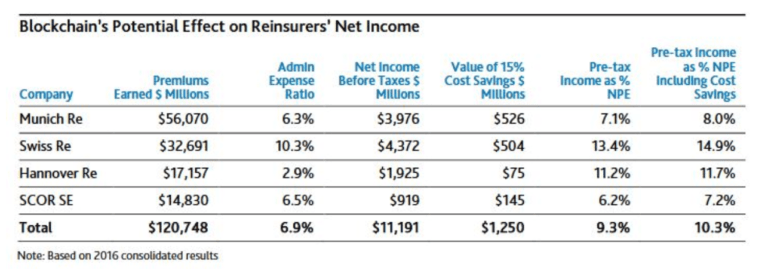

Reinsurance

Blockchain technology can upend current reinsurance processes. It can streamline the information flow of information between insurers and reinsurers with a shared ledger and smart contracts. With blockchain, detailed transactions of premiums and losses can reside on an insurer and reinsurer’s computer systems at the same time. It eliminates the need for books’ reconciliation between institutions for each claim.

With data shared on an immutable ledger and smart contracts managing transaction execution, reinsurers can efficiently allocate capital for claims almost in real-time. Essentially, it will enable them to both process and settle claims quickly without depending on primary insurers for data for each claim.

Also, Read | Blockchain Integration for Operational Excellence in the Reinsurance Industry

As per PricewaterhouseCoopers, blockchain can enable the reinsurance sector to save up to $10B by increasing operational efficiencies.

Source: CBinsights

Conclusion

Blockchain smart contracts can improve the industry in terms of accuracy, efficiency, privacy, and more. However, it is incredibly important to understand that every single insurance company that embraces blockchain must agree to operate according to ethical standards. Standards and protocols need to be coordinated to ensure the blockchain provides insurers with stronger opportunities to communicate, exchange data, and make insurance transactions less of a burden for customers.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.