-

Increasing prices, discerning consumers, and disruption by technology are a few challenges health and life insurance companies face. So, can technologies like blockchain and smart contract solutions development for healthcare enable systems to address insurance issues? Health and life insurance companies are some of the key players trying to incorporate emerging technology blockchain and smart contracts. They are doing so to change record keeping, transaction execution, and interaction with stakeholders. The question is whether blockchain technology and its applications can facilitate insurers to gain efficiency in healthcare insurance operations. Can they enable them to reduce costs, manage vulnerabilities, enhance customer support, expand their business, and thus, improve the bottom line? Let's find out.

What are the Challenges with the Current Healthcare Insurance Services

Life insurance policy life cycles with complex touchpoints and healthcare insurance claims often involve complicated and unpleasant experiences. It makes the establishment of good insurer/client relationships problematic. Term life insurance appears to be a static, one-dimensional product. Whether the policyholder dies, it pays out, or when the contract expires, it lapses. Otherwise, there is no engagement until the sale is closed except for premium payments. With no legal standards demanding its acquisition and little encouragement other than the provision of death coverage, term life insurers continue to be hard-pressed to accelerate strong revenue growth. In reality, life insurance (and maybe even health insurance) tends to be low-return, high-cost products for those who are younger and healthier. They provide little relevance to the everyday life of a policyholder.

What Solutions Does a Blockchain-based System Provide

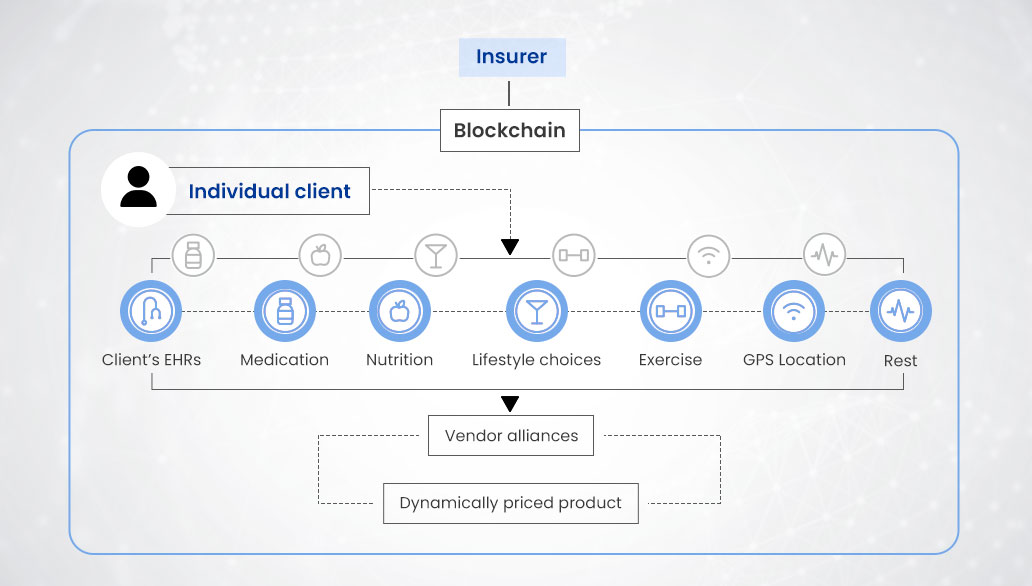

The basis for incorporating a wide range of wellness-related activities into the insurer/client dynamics can be EHRs safely stored on blockchain's immutable database and powered with smart contracts. In this context, technology can not only be used as a secure archive of past medical history to allow faster underwriting and pricing. It can also store near-real-time information about the lifestyle and health of the policyholder through telematics devices tracking their day-to-day activities. Also, Read | Blockchain Smart Contracts in Insurance | Advantages, and Applications

Benefits for a life insurer

In this direction, life insurers can reevaluate a person's risk profile and modify coverage costs accordingly while providing incentives like premium adjustments, exercise or dietary performance discounts, or perhaps even gamification-driven competitions constantly. The architecture of blockchain can incorporate the fast-growing number and types of health and wellness data sources more effectively than a more conventional, widely distributed, and often fragmented communications infrastructure. An interoperable blockchain-based health record system can safely update in near-real-time with diversified, lifestyle-related data points. Further, it can drive more regular revaluations of the vulnerability and enable dynamic premium pricing of life insurance schemes. Potentially, life insurers can harness this gathered information to incentivize risk-reducing behavior individually, thus, facilitating customers to make more knowledgeable, healthier lifestyle choices by aligning with them. They can also provide promotions to related vendors (gyms, fitness facilities, spas, etc.). Carriers may also be in a stronger position to deliver unbundled, customizable, personalized policies. Also, Read | Augmenting the Management of EHRs (Electronic Health Records) with Blockchain

Benefits for a health insurer

In turn, healthcare insurers can use such telematics data to facilitate wellness services and trigger premium discounts. The collection of such real-time data connected to smart contracts in health insurance can alert policyholders to take prescriptions and schedule check-ups. Fluctuations in a patient's health factors like heart rate or blood pressure can set off alarms. This data collection will activate contact from a healthcare care provider or a wellness coach. When combined with advanced analytics and real-time data sources, blockchain-facilitated data storage can ensure owning life and health insurance is an essential part of a policyholder's lifestyle.

Benefits for an insured

Currently, consumers connect with their health insurance when it requires them to pay premiums or consult a disease or injury. Instead, they can establish a long-term positive relationship with their insurer. Exercising and staying productive can lead to obvious and direct benefits — like premium discounts or reduced deductibles. Then, consumers might equate health insurance with well-being and advantages rather than health expenditures. Effectively, insurers may benefit from building a healthier business book that is more risk-averse.

Also, Read | Blockchain Solutions for Reconciliation and Dispute Resolution

Health insurance-specific applications

- Facilitate Health services for insurers

- Create a more reliable medical and wellness knowledge repository

- Cause drug warnings or routine medical visits or diagnostic tests

- Foster healthy lifestyles, reducing the cost of medical complications

- Allow insurers to know their policyholders better

Life insurance-specific applications

- Facilitate faster evaluations of the underwriting and selling

- Create less discretionary, more realistic pooling of risks

- Allow programs geared towards risk reduction and lifestyle and longevity improvements

- Foster revenue growth and augment loyalty programs to policyholders

- Allow more customization and individualized coverage

- Allow insurers to know their policyholders better

But a Nexus of Blockchain, Smart Contracts, and IoT is Essential

Incorporating real-time information might help mitigate arbitrary pricing decisions. It can set the stage for a more engaged customer relationship. However, blockchain alone can not accomplish this. Whether manually uploaded or automatically collected via the Internet of Things ( IoT) sensors, fine-grained lifestyle data points will need to be securely channeled and stored on the blockchain database and converted into successful consumer insights and rewards. Also, Read | Creating a Nexus of Blockchain, AI, and IoT for Business Solutions

Challenges with such a Blockchain-Healthcare Insurance Solution

Moreover, the possibility of tracking and penalizing those who do not practice healthy lifestyles 24/7 might cause some customers to refuse such deals. On the other hand, insurers could face additional regulatory restrictions to protect the interests of both users and non-users.

Conclusion

Using blockchain and smart contracts to support ongoing, interactive, value-added customer relationships may encourage more individuals to buy coverage and stick to their insurer once they do so. It will be more applicable when points created in reward programs are at risk if a policyholder switches carriers. For more detailed information, connect with our experts.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.