-

The development of the DeFi loan and borrowing platform is one of the top five fintech blockchain solutions. There is a great deal of interest in creating these solutions, and businesses are considering creating a DeFi lending platform. This post explains the recommended practices for building a DeFi lending and borrowing platform.

The DeFi Lending Protocols' Functioning Model

Financial services recently faced considerable changes to how they operate. With the advent of blockchain technology, issues with conventional financial systems can now be fixed. DeFi, a concept that offers a fresh viewpoint on financial management, is at the forefront of these cutting-edge solutions. Platforms for borrowing and lending rank among the most common categories of DeFi projects.

The advantages they offer over centralized platforms are what has led to their popularity. Before we examine the advantages, let's take a closer look at the operational model that these platforms employ.

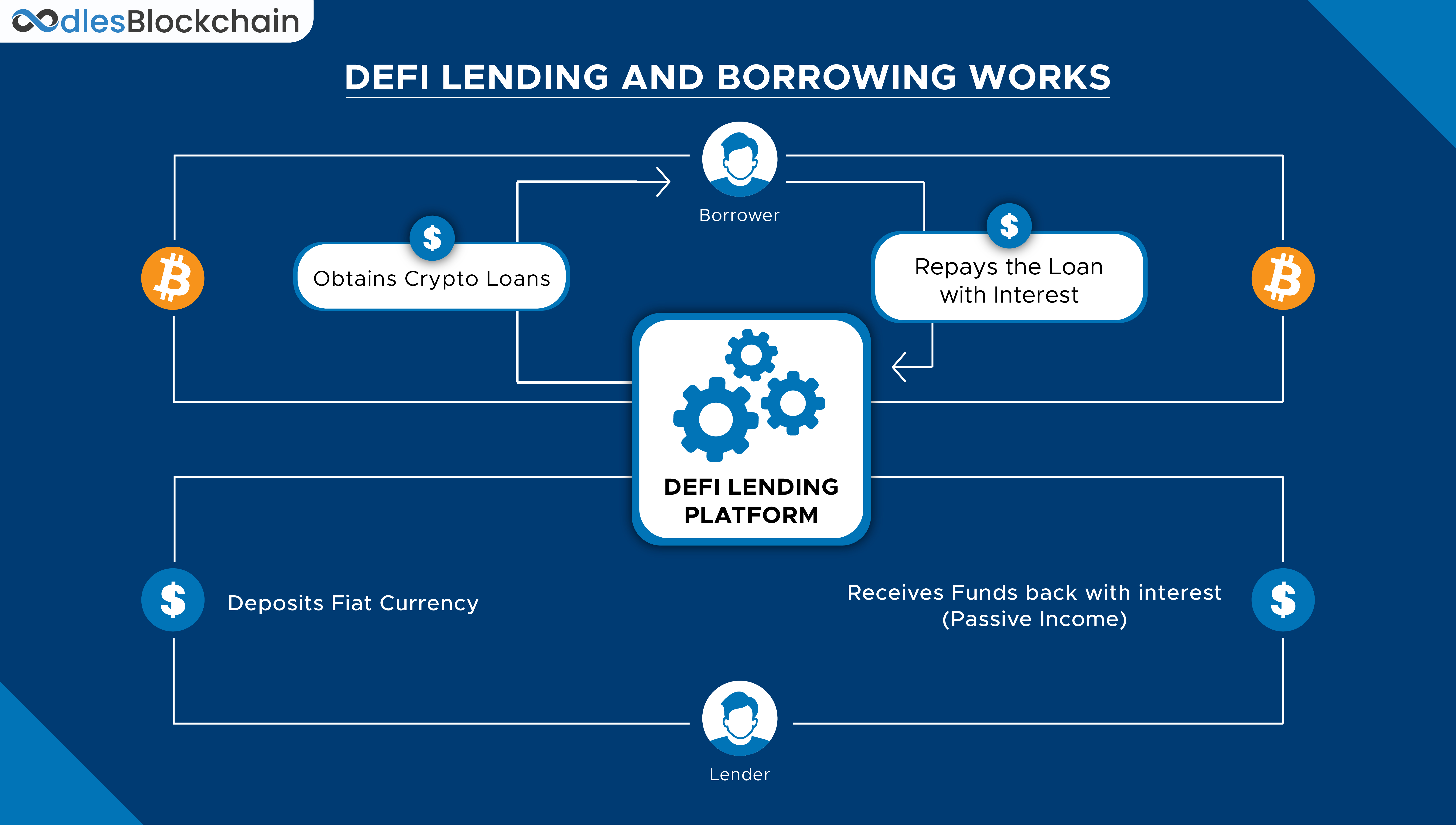

Users can lend and borrow cryptographic assets through the DeFi lending protocols. In a conventional system, the platform provides the borrower with a loan. However, in this case, the platform permits peer-to-peer lending between network users and does not require any outside assistance. Through the site, lenders can receive interest for lending their cryptocurrency holdings. The site also offers long-term investors the possibility to earn large interest rates. As a result, the DeFi lending protocol is advantageous to both lenders and borrowers.

Anyone can become a lender and earn money using DeFi lending protocols, which is a major benefit. By registering on the platform and integrating their digital wallets, individuals can also become borrowers.

Also, Read | Why Develop DeFi dApps and Protocols with Binance Smart Chain

The Operational Strategy used by these Websites is as follows:

- The process is started by the borrower by putting cryptocurrency as security.

- The website uses self-governing smart contracts to distribute loans.

- For borrowing cryptocurrency, the borrowers pay a separate interest rate.

- The lenders receive the interest that borrowers pay.

That is also how these platforms function. Now that you are aware of the operating model, it is time to consider the advantages it offers.

Also, Read | Developing an Advanced DeFI (Decentralized Finance) Wallet

Benefits of Developing the DeFi Lending Platform

More Rapid Borrowing

Users receive their loans promptly thanks to the Smart contracts on the DeFi platforms. Users merely need to connect their digital wallets to the website and submit a request. Here, there is no involvement from a third party, which streamlines procedures and expedites the loan approval process.

There are no Middlemen

Autonomous protocols that operate without human supervision are known as smart contracts. Lenders and borrowers can create contracts using smart contracts. The lack of external supervision hastens the loan issuance procedure. Now, lenders can earn huge returns while borrowers can borrow money at low-interest rates.

Permissionless

Anyone with a cryptocurrency wallet can join DeFi platforms, which are open and transparent ecosystems. There are no restrictions on location or credit history in this case. By fulfilling the platform's standards, a user can use the platform as a lender or borrower.

Transparency

These platforms preserve user confidence and operate with a high degree of transparency. The DeFi lending platforms employ blockchain technology and give consumers access to the system's workings and smart contract code.

Power over Cryptocurrency Assets

Nobody should be surprised that some centralized platforms are vulnerable to cyber attacks or technical failures. Here, people maintain ownership of their resources and take the necessary precautions to safeguard their data.

The aforementioned paragraphs highlight a number of advantages of developing a DeFi borrowing platform. You may be considering expanding your DeFi loan and borrowing platform as a result of seeing this. A successful DeFi platform should have a number of key components. These attributes are listed below.

Also, Read | NFT and DeFi Solutions | Disrupting the Financial Space

Essential Features for the Development of the DeFi Lending and Borrowing Platform

Before accessing the website, users must first have a cryptocurrency wallet. Therefore, it is crucial to specify the many types of wallets the website accepts. Prior to continuing, choose which integrations your website needs. These are the key characteristics.

Quick Loans

One type of lending without collateral is flash loans. With the growth of DeFi lending platforms, this feature became more and more popular. The user can borrow money from this site without putting up any security. These loans do, however, have a short term and are automatically canceled if the borrower is unable to make payments by the due date. If the conditions are not met, smart contracts manage the process and prevent fund transfers. So, in order to complete the transaction, the borrower must repay the loan. If not, the loan is canceled via the smart contract.

Also, Read | Understanding DeFI Flash Loans and How to Make them Secure

Switching Rates

The market for crypto assets is inherently erratic. Users can therefore benefit from a rate-switching functionality. Users can choose between fixed and variable interest rates here, shielding themselves from unforeseen market fluctuations. When borrowing, this function offers some steadiness to borrowers.

Gateway by Fiat

Users are now able to use fiat money to buy digital assets thanks to this innovation. This will prevent them from leaving the site due to complexity and going to a third-party site. The user experience is enhanced by this functionality, which also satisfies client needs. It also makes the onboarding process for new users simpler.

Investing Gains

Giving consumers a fair return on their investment is one method to encourage them to contribute money for borrowing. These services present lenders with a chance to profit passively from crypto assets. Consider creating a number of lender incentive programs to motivate them to make long-term investments on the platform.

Read More | A Guide to Defi Token Development Like Safemoon

Conclusion

DeFi is a ground-breaking idea that gained popularity immediately. DeFi loan and borrowing systems offer a number of advantages that people adore. Businesses strive to improve their DeFi lending policies every day in order to gain benefits. So, if you want to take advantage of this rich industry, the time is now. Find the best business to assist you in creating your DeFi lending and borrowing platform. Connect with our blockchain and crypto development experts for more information about Defi lending and borrowing platforms.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.