-

In this blog, we analyze how blockchain and smart contracts are revolutionizing insurance claims processing. In the last few years, blockchain technology has gained significant traction across various industries as the most exciting technological development. Blockchain business solutions are making business activities more convenient and secure, like tracking medical supplies, removing banking bottlenecks, and streamlining governance and non-profit activity.

Blockchain Technology

It is a type of distributed ledger technology-based digital database, similar to an Excel spreadsheet. The database encompasses a network consisting of numerous computers (nodes) and remains completely public. Thus, it serves as a single source of truth. Every time there is an update on the network database, the blockchain ledger automatically updates its information across the network. Further, cryptographic techniques make the database secure, and near impossible for hackers to make changes to it. The only way to make changes is to hack more than half of the nodes in the blockchain. In addition, smart contracts on the blockchain ensure the protection of complex business contracts from deletion, tampering, or revision. Also, Read: How Blockchain is Proving Transformative for Insurance Processes

Understanding Smart Contracts

Smart contracts are standardized, fully automated, and autonomous financial instruments deployed on blockchain. They facilitate, verify, and enforce attributes of a contract according to predetermined scenarios on a blockchain solution.

Applications of Blockchain In Insurance | Benefits

The combination of blockchain and smart contracts can streamline, modernize, and enhance the siloed infrastructure of the insurance sector using a shared ledger of common information.

Simplified Operations

Reduces human intervention required to perform reconciliation and fix disputes.

Enhanced Regulatory Efficiency

Enables real-time tracking of financial activities across business processes.

Reduced Counterparty Risk

Smart contracts eliminate the need to rely on counterparties to achieve obligations.

Reduced Clearing and Settlement Time

No need for third parties for verification/validation and thus, accelerating settlements.

Minimized Frauds

Enables complete transaction history and asset provenance maintenance within a single source of truth. Also, Read: Blockchain in Insurance: Enhancing Existing Complex Processes

Applications of Blockchain In Insurance | Challenges

Blockchain-based insurance services can enhance simplicity and efficiency by establishing new financial infrastructure and processes. The processes and businesses powered by blockchain can address multiple pain points prevalent across the insurance value chain. Here are a few current pain points in different insurance processes, including claims processing and settlements, client onboarding, underwriting, and more, that blockchain and smart contracts can address:

- Inefficient systems for information exchange

- Fraud-prone

- Manual and laborious claims processing

- Intermediaries

- Fragmented data sources

- Limited underwriting accuracy

- Complex Liability Assessment for Syndicates/Reinsurance

The above challenges result in inefficiencies and increased difficulties in insurance claims processing. They impact insurers, policyholders, and all parties involved in a claim. So, for instance, we will analyze how blockchain can boost efficiency, reduce fraud, and improve customer experience in claims processing.

Automated Insurance Claims Processing with Blockchain and Smart Contracts

We will use blockchain and smart contracts for insurance claims processing. All parties associated with an insurance claim will access the distributed insurance ledger to view policy details. Policyholders will add data to support claims to the distributed ledger while making a claim. This data may include proof of insurance, claim forms, evidence, etc. Policyholders will interact directly with claims processors. All of this interaction will happen on the blockchain. Here, smart contracts will drive the workflow for a claim. For policyholders, blockchain will also have an active policy and smart contracts with pre-determined claims conditions stored on it. Then, the claim amount will be processed without requiring human intervention. It decreases the likelihood of human processing errors. We will divide the process into the following phases.

Registration of Authorized Insurance Providers on a Blockchain Platform

The process will begin by onboarding stakeholders involved in the first phase of the process on the blockchain platform. Insurance Providers: Authorized insurance providers are those who form insurance policies and offer them to consumers. They will add relevant insurance policy details on the blockchain. For instance, a motor insurance provider while adding the plans will save details like term length, date of validation and expiry, coverage amount, no claim bonus, co-pay percentage, centers covered under the policy, types of coverage available in a specific plan, and terms and conditions on the blockchain. Brokers: They act as advisors rating the insurance policies provided by insurance providers. Their involvement in the process will not be as an intermediary but as an advisor. They will access the details saved by insurance providers on the blockchain. They will give their ratings to the insurance policies added by providers. It will help insurance companies and consumers to make informed decisions. Policy Portal Admin: They offer insurance quotes to customers. Their role will be to fetch insurance plans from the blockchain platform and add them to their portal. It will reduce the time they spend contacting insurance providers manually.

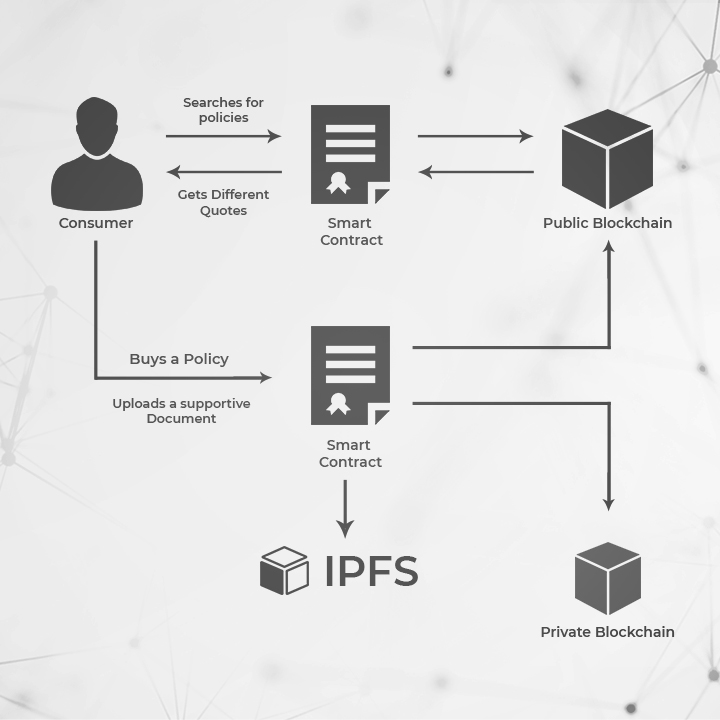

Consumers Search and Buy Policies

Stakeholders involved in the second phase of the process will be consumers and insurance companies. Consumers: They search for the right insurance policy to buy it. On the platform, they will search for specific insurance policies using their mobile app. For example, if a consumer wants to buy a policy for health insurance, he would search for it. With smart contracts, he will get search results related to health insurance quickly. While buying a policy, the consumer will upload necessary documents like address proof, age proof, passport-size photos, identity documents, and income proof to the distributed database, for instance, IPFS, with addresses hashed and stored on the private blockchain. Insurance Companies: As soon as a consumer buys the insurance plan, the insurance company will get a notification. Then the consumer will submit his details. The insurance company will start validating the details and add the customer to their private blockchain system upon identity verification. Insurance providers send a receipt of acknowledgment to the consumers to inform them of their plan activation. Since the blockchain stores transaction records, they will be immutable and traceable. Thus, there will be no chance of insurance fraud.

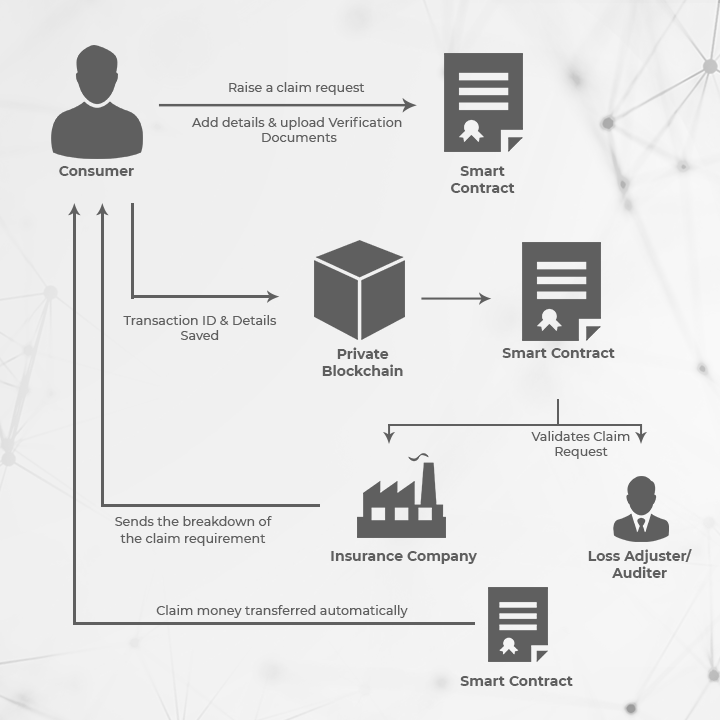

Consumers Request for Claim Amount

Stakeholders involved in the third phase of the blockchain insurance process will be consumers, auditors, and the insurance company. Consumers: A consumer requests the claim amount from his insurance provider. If a healthcare policyholder meets with an accident, he can claim an amount from the insurance company. He will have to follow the claim request procedure for its approval. They may need to share documents supporting evidence, photographs, and other claim-related details on the private blockchain. The private ledger will save the documents with their respective transaction IDs. Network participants can see all this data. Auditor: They verify if a policyholder is liable to get the amount of claim or not. Auditors or loss adjusters get a notification when a policyholder makes a claim request and submits supporting documents on the platform. They perform an in-depth verification and validate the authenticity of the documents. If they find the evidence accurate, they approve the claim request and add details on the blockchain. Insurance Company: Provides the claim to consumers. Once the auditor has approved the request, the insurance company forwards the breakdown of the claim account to the consumer. Finally, smart contracts automatically transfer the claim money to the policyholder. That is how blockchain with smart contracts reduces the turnaround time by simplifying the entire claim processing and settlement process.

Also, Read: Blockchain in Insurance: Enabling New Opportunities

Also, Read: Blockchain in Insurance: Enabling New OpportunitiesA Hypothetical Use Case | Simplifying Travel Insurance Claims Processing with Blockchain and Smart Contracts

Blockchain can help to design a solution for the travel insurance industry. The solution will minimize paperwork by enabling the insured to upload the documents via their smartphones. The solution will have a smart contract of the insurance agreement made between the insurer and the insured. The smart contract will execute autonomously if the involved parties meet the specified condition(s). In the case of a claim, the conditions will be the occurrence of predefined events and automated verification of the claim. The solution will store all detail securely and enable stakeholders to access them anytime in the future. For instance, the solution will drastically reduce claim settlement time for frequent travelers related to flight delay claims. Also, it will enable them to get insurance policies seamlessly through smartphones without requiring them to submit long proposal forms. The solution will use smart contracts for automated claim settlement, flight data from third-party providers to trigger smart contracts, and a mobile app with OCR – ICR ability to capture data from an image automatically.

Also, Visit: Blockchain Integration for Operational Excellence in the Reinsurance Industry

Also, Visit: Blockchain Integration for Operational Excellence in the Reinsurance IndustryConclusion

In the future, we can expect more blockchain PoCs (Proof-of-Concept)and use case development across the insurance industry. Blockchain integration will be one part of the larger move toward a digital-first operating model. For insurers trying to address challenges like privacy and data security risks, poor customer experience, and costly manual administrative processes, blockchain will certainly be part of the solution. If you want to develop a similar blockchain project, talk to our blockchain developers.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.