-

When starting a crypto exchange business, investors often overlook the pre-development aspects. They directly dive into the development process to beat the competition by immediately launching the platform in the market. As a result, the platform meets with low adoption, below-average performance, and legal issues. However, by paying attention to the following pre-development steps, they can ensure the platform's success with comprehensive and efficient development. There's also an option available called turnkey exchange software development that enables businesses to run a crypto exchange platform in less than six weeks. With that approach, one does not need to explore the following pre-development process.

Pre-development Factors: Cryptocurrency Exchange Software

Legal counsel and license requirements

It is necessary to understand the legal and regulatory requirements for developing a cryptocurrency exchange platform. You should avail the services of a legal firm that specializes in fulfilling licensing requirements applicable in your regional jurisdiction. In some countries, crypto exchanges operate without many restrictions and oversight imposed by governments and regulations. However, in countries like the US, exchange operators need to be licensed traders and must comply with the requirements laid down by regulators like the SEC and CFTC. In this situation, consulting an industry-specialist attorney saves you from all the legal headaches.

Gather enough capital to support the venture

Assess the approximate cost that will be involved before the development of an exchange platform, including expenses related to technology, platform hosting, initial stage legal counsel, government licensing, and initial advertising. Although you won't need all funds beforehand, ensuring that the venture has enough capital provides a smooth ‘ideation to production' path. It is a mistake that most startups make by defining improper planning and projection. They raise small initial funds to cover the cost of the development process only. It leaves them with no other operational funds until the venture becomes profitable. Startups also make another mistake of obtaining a license from untrustworthy service providers. Such providers do not mention the obligations and regulatory standards for setting up and maintaining the exchange and charge unnecessarily.

Find a technology solution provider

Hiring an offshore development company rather than setting up an in-house team can be a cost-effective decision. Cryptocurrency development companies in countries like India charge relatively low and provide full-suite development services with a complete tech stack and skilled developers. (benefits) Oodles is a crypto exchange development company that has no hidden charges or ongoing fees, or commission structures. Clients get complete access to the exchange source code. Some regulators may request a source code audit. Having access to the complete code makes auditing a hassle-free process.

Connect with other exchange platforms to increase liquidity

Smooth liquidity determines the success of the exchange business. If your exchange platform does not operate with an order book and a trading activity chart, you may lose potential customers. Instead of simulating these features via dummy accounts within the platform, you can connect it with other exchanges. It aids in increasing the liquidity as the platform operates within a network of exchanges.

Integrate the best security processes

Security is another crucial aspect that ensures the widespread adoption and success of a platform. Ensure that your exchange is being built with the best security practices to prevent hacks and cyber attacks. We, at Oodles, develop secure, heavy-duty exchange platforms by implementing securities like hot/cold wallets, 2FA, and encrypted databases, among others.

PR Campaign and Marketing

Often, exchanges exclude the marketing budget from the overall development cost. They rely on free social media marketing. It is important to plan the marketing activities, along with other costs, beforehand to reach a critical mass of traders.

Maintain ongoing legal compliance

It is necessary to maintain legal compliance and follow all laws and regulations proposed by the government and authorities. It not only applies to your exchange's jurisdiction, but also to all foreign jurisdictions from where your exchange users will be trading. A cryptocurrency development company that provides comprehensive services can fulfill your ongoing compliance needs as cryptocurrency laws evolve globally.

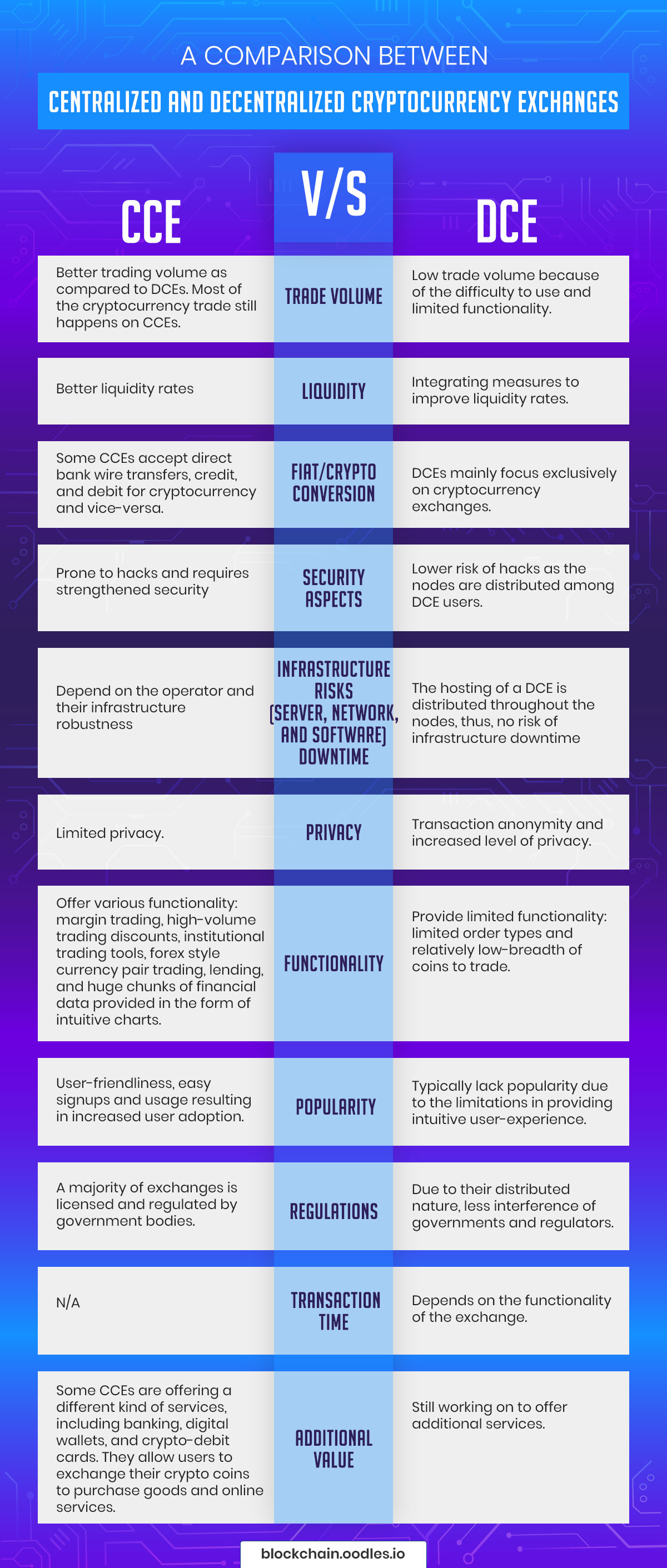

Types of Cryptocurrency Exchanges

Understanding the difference between the following exchange platform types is important. Both exchange platforms present different distinctions, advantages, and benefits. Although the development method of these platforms may vary, the pre-development aspects, to a significant extent, remain the same.

Centralized Cryptocurrency Exchanges (CEX)

A majority of the existing exchange platforms fall into this category. It's because they provide better liquidity rates than other types. CEXs generate sufficient capital to sustain platform development with provisions for country-specific regulatory compliance. They enable the exchange of cryptocurrencies for fiat (fiat/crypto pair) and other cryptocurrencies. They don't cut out the middleman (escrow) from the transactions like decentralized exchanges. Now, CE Cryptocurrency Exchange PlatformXs also implements AML checks and KYC mechanisms for trusted user adoption.

Decentralized Exchanges (DEX)

Decentralized exchanges are based on peer-to-peer transactions and involve no transaction intermediaries. DEXs benefit users by providing the autonomy to manage funds with secure cryptography-based wallets. They eliminate the role of escrow and execute automated transactions with smart contracts and atomic swaps. DEXs are efficient, secure, and transparent platforms that execute transactions anonymously in a private manner, like blockchain.

Concluding Thoughts

It's best to avoid unpleasant surprises while setting up a crypto exchange business. Several countries have established regulations to keep a check on criminal activities involving cryptocurrencies. The services of a competent legal firm will ensure that you can focus on business activities rather than dealing with compliance issues. If you want to explore the business opportunities in the crypto exchange domain, schedule a call with our technology experts and consultants.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.