-

Yield farming has quickly become one of the defining features of decentralized finance (DeFi). By locking up or lending crypto assets, investors can earn passive rewards while fueling liquidity in DeFi ecosystems. What started as an experimental model has now evolved into a multi-billion-dollar market, attracting traders, developers, and institutions alike. In this guide, we'll break down what yield farming is, why it gained so much traction, the pros and cons of participating, and the top protocols driving its growth. If you're planning to launch your own DeFi project, explore our DeFi Yield Farming Development Company services.

What is Yield Farming?

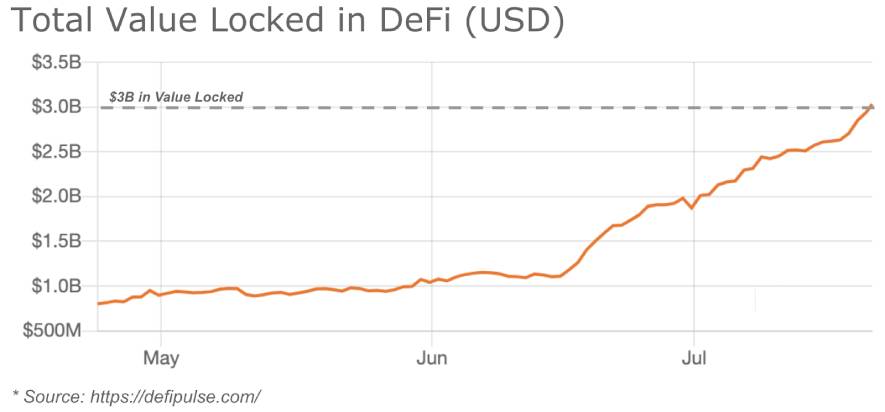

Staking or lending crypto assets to produce high returns or incentives in the form of additional cryptocurrency is known as yield farming, an emerging concept in the space of cryptocurrency exchange development and smart contract solutions. Thanks to new technologies like liquidity mining, this revolutionary but risky and unpredictable application of decentralized finance (DeFi) has exploded in popularity recently. Yield farming is currently the most important growth factor in the still-developing DeFi sector, helping it to expand from $500 million in market capitalization to $10 billion by 2020. Yield farming protocols, in short, encourage liquidity providers (LPs) to stake or lock up their crypto assets in a smart contract solution-based liquidity pool. A proportion of transaction costs, interest from lenders, or a governance token may all be used as rewards. These returns are calculated as a percentage yield on an annual basis (APY). The value of the released returns rises as more investors allocate funds to the associated liquidity pool. The majority of yield farmers initially staked well-known stablecoins such as USDT, DAI, and USDC. The most common DeFi protocols, on the other hand, now run on the Ethereum network and offer governance tokens for liquidity mining. Also, Read | DeFi (Decentralized Finance) | Emerging Finance Alternative

What Sparked the Rise of High-Yield Farming?

The introduction of the COMP token – the Compound Finance ecosystem's governance token – has sparked a surge of interest in yield farming. Token holders get governance privileges for governance tokens. However, the question is the distribution of these tokens happens while keeping the network decentralized? Distributing these governance tokens algorithmically with liquidity bonuses is a common way to kickstart a decentralized blockchain. Liquidity providers feel enticed to “farm” the new token by providing liquidity to the protocol. Although the COMP didn't invent yield farming, it did raise the popularity of this form of token distribution model. Other DeFi ventures have also devised creative ways to draw liquidity to their ecosystems.

What are the Advantages and Disadvantages of Yield Farming?

Profit is one of the most obvious advantages of yield farming. Yield farmers who are among the first to implement a new project may be rewarded with tokens that rapidly appreciate. Huge gains are possible if they sell tokens at the right time. Those profits can be re-invested in other DeFi projects to increase yield even more. Also, Read | Blockchain-based DeFi | Understanding the Decentralized Financial Shift Yield farmers must typically invest a substantial amount of money upfront to make any significant profits — even hundreds of thousands of dollars may be at stake. Yield farmers face a major liquidation risk if the price drops unexpectedly, as it did with HotdogSwap, due to the highly volatile nature of cryptocurrencies, particularly DeFi tokens. Also, the most effective yield farming techniques are complex. As a result, those who don't completely comprehend all of the underlying protocols are at greater risk. Yield farmers have put their money on the project teams and the smart contract code that underpins them. Many developers and entrepreneurs are entering the DeFi space because of the opportunity for profit. They start projects from the ground up or even copy the code of their predecessors. Even if the project team is trustworthy, the code often remains untested. It makes it prone to bugs and vulnerable to attackers.

Key Challenges and Opportunities with Yield Farming

The Ethereum blockchain is used for the majority of DeFi applications, posing some significant challenges for yield farmers. The Ethereum network is experiencing scalability issues ahead of the 2.0 update. As yield farming becomes more common, the Ethereum network becomes clogged, resulting in long confirmation times and rising transaction fees. As a result of this scenario, some have speculated that DeFi could end up self-cannibalizing. Ethereum's problems, on the other hand, seem to be more likely to support other networks in the long run. The Binance Smart Chain, for example, has emerged as a viable alternative for yield farmers who flocked to the network to take advantage of new DeFi DApps like BurgerSwap. Additionally, Ethereum's existing DeFi operators are attempting to solve the problem with their second-layer solutions for the network. As a result, assuming that Ethereum's issues do not prove fatal to DeFi, yield farming will continue to exist for some time to come.

Also Read | How Blockchain Helps to Transform the Trade Finance SectorThe five Yield Farming Protocols

To maximize the returns on their staked funds, yield farmers will frequently use a variety of DeFi platforms. These platforms include a variety of incentivized lending and liquidity pool borrowing options. Here are seven of the most popular yield farming techniques.

Compound

It is a money market for lending and borrowing funds, where users can gain algorithmically modified compound interest as well as the COMP governance token. MakerDAO It is a decentralized credit pioneer that allows users to borrow DAI, a USD-pegged stablecoin, by securing crypto as collateral. A "stability tax" is chargeable in place of interest.

Aave

It is a decentralized lending and borrowing protocol that allows users to borrow assets and receive compound interest for lending using the AAVE (previously LEND) token. Aave is popular for promoting flash loans and credit delegation. Borrowers can receive loans without putting up any collateral with this protocol.

Uniswap

is a well-known decentralized exchange (DEX) and automated market maker (AMM) that allows users to swap almost any ERC20 token pair without the use of a third party. Liquidity providers must stake 50/50 on both sides of the liquidity pool to gain a share fee and the UNI governance token.

Yearn.Finance

It is a decentralized aggregation automation protocol. It enables yield farmers to use different lending protocols such as Aave and Compound to get the best yield. Yearn. finance uses rebasing to optimize the benefit of the most efficient yield farming services. Curve, Harvest, Ren, and SushiSwap are some other notable yield farming protocols. For more information about Yield Farming, you may connect with our blockchain and cryptocurrency development experts. They possess the requisite knowledge and expertise in the domain of decentralized finance.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.