One of the most exciting innovations in decentralized finance (DeFi) is the tokenization of real-world assets (RWAs). Using crypto token development services, developers can create digital tokens that represent ownership in assets such as stocks, bonds, real estate, or even fine art. A leading framework in this space is ERC-3643, also known as the T-REX (Token for Regulated Exchanges) standard, which is specifically designed to add compliance and regulatory safeguards to RWA tokenization.

Traditional token standards like ERC-20 allow for fractional ownership and faster trading but fall short on regulatory compliance. Without built-in mechanisms, it's difficult to enforce investor eligibility, KYC checks, and AML requirements, which increases risk and limits adoption. ERC-3643 addresses these gaps by embedding compliance features into the token's lifecycle. For businesses exploring secure and compliant tokenization, working with an experienced asset tokenization development company ensures proper design, deployment, and scalability of RWA projects.

Understanding ERC 3643

ERC-3643 tackles these issues by introducing a permissioned system with built-in compliance features. This ensures that only authorized participants can interact with security tokens, while functionalities like token roles and freezing mechanisms empower issuers to enforce regulations and enhance security.

You may also like | Understanding ERC-404 | The Unofficial Token Standard

The adoption of ERC-3643 unlocks a range of benefits for issuers, investors, and regulators:

- Issuers: Gain access to a wider pool of qualified investors, streamline compliance processes, and enhance security for their tokenized assets.

- Investors: Benefit from increased transparency and security in security token offerings, along with potentially more efficient trading.

- Regulators: Have a framework that facilitates regulatory oversight and fosters innovation within a compliant ecosystem.

ERC-3643 opens doors to exciting use cases, including:

- Fractional Ownership of Assets: Making high-value assets like real estate or fine art more accessible to a broader range of investors.

- Streamlined STOs: Simplifying the process of issuing and managing security tokens while ensuring compliance with regulations.

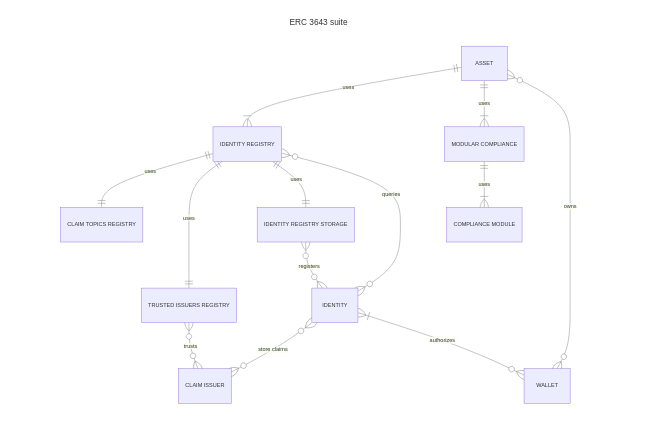

- Automated Regulatory Compliance: Smart contract functionalities can automate aspects of compliance, reducing manual processes for issuers and regulators. An ERC3643 asset is backed by a set of contracts, as described below

- Asset contract: Usually, an asset contract is a contract that represents an asset. ERC20, ERC721, ERC1155, or any other kind of asset could serve as its foundation.

- Identity Registry: To authenticate any transfer, the asset contract will first check to see if the addresses involved (often just the receiver) are registered and have the necessary claims.

- Identity Registry Storage: Identities are typically saved in a separate contract called Identity Registry Storage; they are not stored in the Identity Registry itself. This makes it possible to share a single identity register with other identity registries that have various claim criteria.

- Claim Topics Registry: For the identity registry "isVerified" must return true. to indicate that the given identity has at least one legitimate claim under each claim topic.

- Trusted Issuers Registry: The identification registry will make sure that only claims submitted by these reputable claim issuers are approved through the Trusted Issuers Registry.

- Modular Compliance: or any tailored application of a contract for compliance. The Compliance contract verifies a transfer's legitimacy in light of its regulations using its module.

- Compliance Module: These modules put particular guidelines and regulations into practice for compliance.

- Claim Issuer: ERC3643 expects that claim issuers adhere to the standard and use the necessary isClaimValid method, even if claim issuers are a part of the ONCHAINID standard.

Also, Explore | ERC-721 Non-Fungible Token Standard Development

Reference: https://github.com/ERC-3643/documentation

For more about ERC token development, connect with our smart contract developers to get started.