-

In this blog, we explore the role of blockchain application development in developing payment processing solutions. Anyone interested in understanding the consequences of blockchain in the payment industry can use this guide to get more information.

There has not been a single major payment system in recent years that did not disclose the use or incorporation of blockchain technology in its services. Western Union, Visa, Mastercard, PayPal, SWIFT, as well as major commercial and central banks are all involved in the technology. They are progressing from theory and research to blockchain transactions reality. Thus, we are speaking about what triggered the increased interest in blockchain technology.

Challenges with Payment Processing Systems

These days, the industry is full of problems and needs a reality check. Let's see what the key problems are right now, or this industry.

- Frauds in fees and chargebacks

- Cross-border transactions delayed

- Currency Exchange Difficulty

- Lack of sufficient technological integration

- Low Fees for Production

- Across countries, dynamic financial supervision

- Low satisfaction with clients

- Increasing cyber threats

- KYC Repeated Procedures

Why Use Blockchain Solutions for Payment Processing?

For different purposes, businesses that want to continue with blockchain as their future in digital payments will make the switch due to the following:

- No fees for processing

- No need for personal data to be used to complete a transaction

- Faster speeds for production

- Preventing duplicate spending and false-positive errors

- The technique makes it impossible to falsify transactions

- Ledger copies are available across the network, preventing loss of data

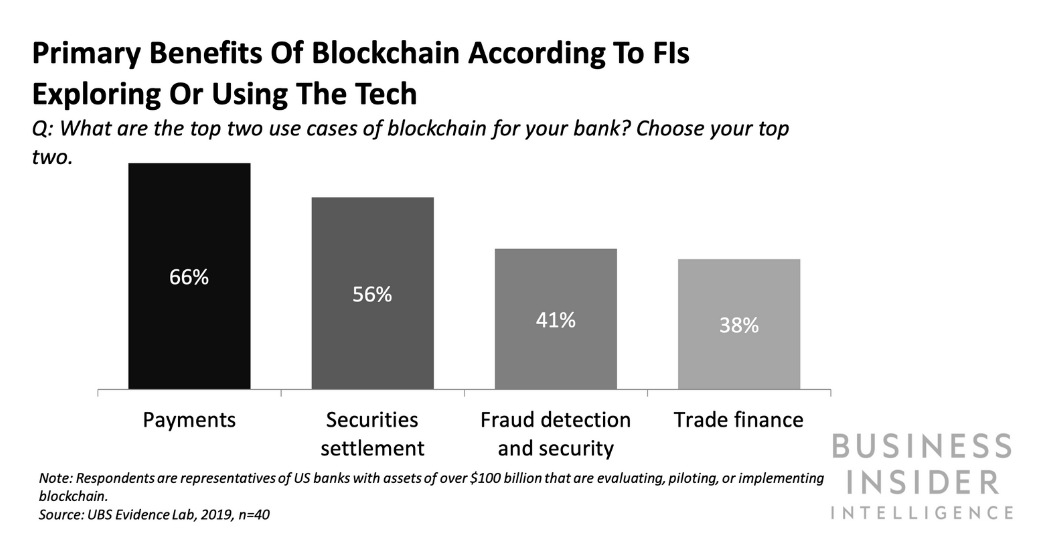

Source Business Insider

Blockchain Solutions for Payment Processing

Advanced Peer-to-Peer (P2P) Payments Solutions

Peer-to-peer transactions are another important application of blockchain payment systems. Using blockchain technology can allow you to transact directly with another person. To do so, you would not have to go through a middleman or a central authority.

While P2P transfer applications are already on the market, as they all come with some sort of restriction, they are not able to give you full freedom. They might, for instance, endorse only a single geographic area or provide a particular region. But there is no solution for any constraints in a blockchain. Money can be transacted from anywhere in the world.

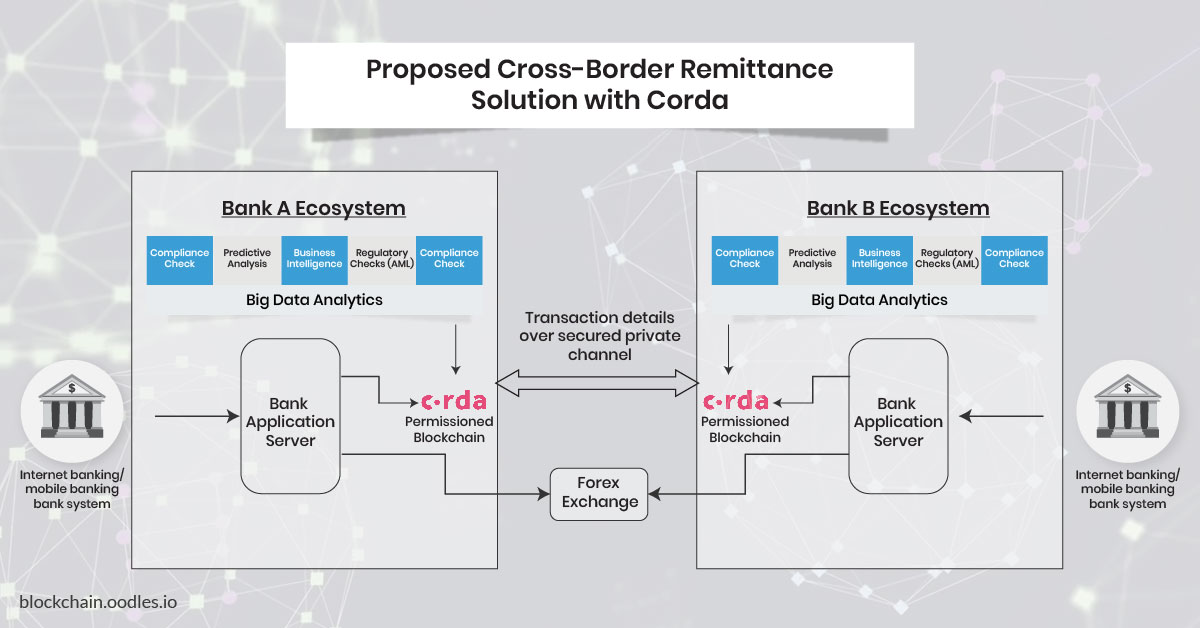

Quicker Cross-Border Transactions

Cross-border transfers are an important part of the business market. But making a cross-border payment nowadays takes a lot of time. It can also take up to 6 days to process that, even though you are not using a banking channel to process the transactions.

This can have quite a negative impact on the business world. On the other hand, a quicker processing time can potentially be provided through blockchain based payment methods. Actually, instead of days, you can process a transaction within seconds! It can improve the productivity of so many companies.

Also, Read | Addressing Challenges of Cross-Border Payments with Blockchain

Automated processes for Know The Customer (KYC)

The KYC method is not, as you already know, as simple as it sounds. In reality, it involves a lot of paperwork and requires a lot of official documentation to verify it. Suppose, however, that a client wishes to use another payment provider. He/she has to do the same method all over again in that situation. Since there is no way for banks to use other banks' information to check it, the customer has to repetitively deal with the same procedure.

Yet a customer would have to go through the process only once with blockchain-based payment methods. Many of the systems will be automated after that. Blockchain is a sharable yet safe type of ledger system. So, banks can communicate with each other from one bank to another and use the KYC data.

Also, Read | Solving the Issues of the Current Centralized System of KYC with Blockchain

Better Protocols for Anti-Money Laundering (AML)

Many banks or payment providers are victims of these illicit activities due to the absence of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) protocols. For example, in 2012, HSBC bank had to pay a fine of $1.9 billion for getting involved in the Colombian Norte del Valle cartel and Mexican Sinaloa cartel money laundering scheme.

Blockchain for payment AML processing schemes, however, may potentially change the situation for good. The use of a blockchain billing system would assist honest banks to help keep up with enforcement. Also, they can easily recognize any kind of criminal activity that could arise in the long run.

Reduced Transaction Fee for Payments

When it comes to payment processors, transaction fees are a big concern. The burden is, in fact, both for customers and businesses. In many cases, with each year, processing fees often rise, and in many situations, the differences in processing fees are very complex.

It is also very difficult to keep track of the production costs and how much they would cost in the long term. But there won't be any need for a middleman for blockchain based payment platforms. So, you're just not going to have to pay any processing fees for it. This lowers the number of transaction costs for both companies and customers considerably.

Companies using Blockchain Solutions for Payment Services

Santander Banco

In the payment industry, Banco Santander uses blockchain to streamline its digital identity project. The business is working on an integrated digital identity scheme with other participants. Also, this project would give its consumers greater power over their information and how they choose to use it.

PayPal

The company offers users to purchase, sell, and even keep cryptocurrencies from their PayPal wallets or digital tokens. This will open up new opportunities in the future for businesses.

MasterCard

One of the payment service firms that also use blockchain is MasterCard. They have a forum for digital currency research that can help banks cope with the CBDC initiative (the digital currency of the central bank). Also, this platform will illustrate how the client can use the currencies to pay in daily life.

Also, Read | Making Secure Online Payments with Blockchain-Based Crypto Wallets

Conclusion

In the end, without any complications, using blockchain in the payment industries will potentially help get rid of a lot of the problems. Better handling of transactions, more protection for your data, and control of your digital identity can be accomplished. We assume that blockchain implementation will genuinely give advantages for both companies and consumers.

Connect with blockchain development experts if you are interested in integrating blockchain into your payment systems.

Our Offices

INDIA

Emaar Digital Greens, Sector 61,

Gurugram, Haryana

122011.

Welldone Tech Park,

Sector 48, Sohna road,

Gurugram, Haryana

122018.